Banned Russian oligarchs used a UK privacy loophole to evade sanctions.

Sanctioned Russian oligarchs from Vladimir Putin's inner circle exploited a UK secrecy loophole left open by the government.

Banned Russian oligarchs Arkady and Boris Rotenberg, who are judo partners with the president of Russia, used a form of corporation that did not need to disclose its genuine owners so that they could continue their business. Officials from the government have acknowledged the concerns over the potential for criminals to abuse these organizations, which are known as English Limited Partnerships (ELPs).

A joint investigation by Finance Uncovered and the BBC has uncovered evidence linking multiple ELPs to money laundering, terrorism, and fraudulent activity.

Between 2016 and 2017, the government imposed laws requiring almost all British businesses to disclose the names of their real owners. Nevertheless, these updated transparency laws did not apply to ELPs.

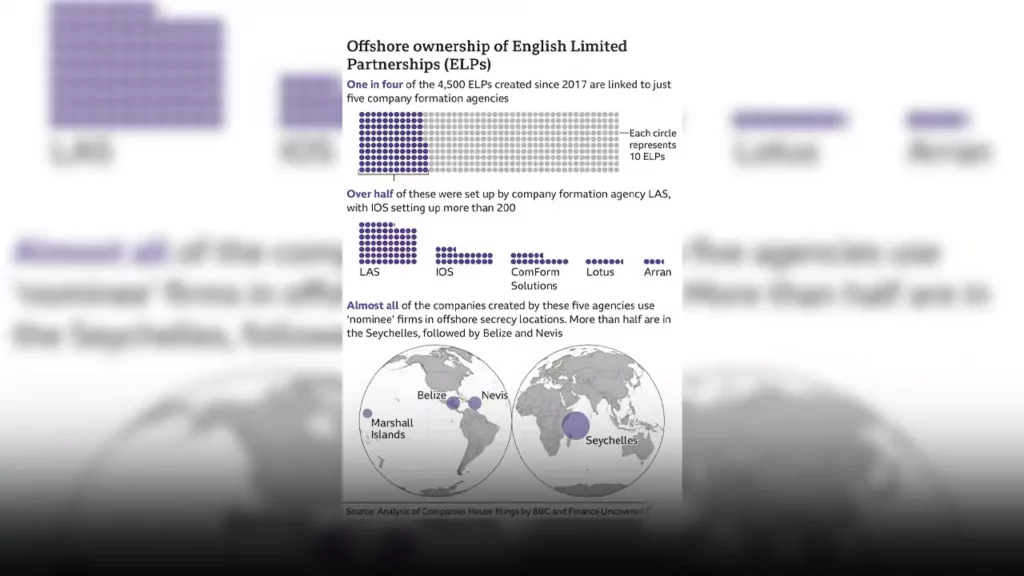

Over 4,500 of them have been established since then.

The BBC and Finance Uncovered worked together to review a plethora of company records and leaked documents that demonstrate how ELPs have developed into a way to get around anti-money laundering laws that require the identification of real owners or persons with substantial influence over UK companies.

Because of their tax advantages and built-in cap on maximum loss, equity limited partnerships (ELPs) are widely used in pension, real estate, and investment funds.

ELPs do not have separate legal identities like regular companies do. Government rules therefore state that they are not allowed to own property, do not have a named beneficial owner, and are not allowed to create bank accounts on their own.

However, our inquiry has uncovered records that reveal the individuals who benefit from ELPs, as well as proof of their utilization in establishing bank accounts and aiding in financial misconduct. Graham Barrow, a specialist in financial crime, has noted that they can be easily exploited due to the minimal disclosure of their activities that is mandated.

Our investigation has turned up documents that list the beneficiaries of ELPs and demonstrate how they are used to open bank accounts and support financial malfeasance. Financial crime expert Graham Barrow has observed that because of the minimum transparency of their operations that is required, they are easily exploitable.

“I wish I could be shocked about the scale of this, but I’m absolutely not. I’m just depressed and frustrated,” says Helena Wood, head of the UK Economic Crime Programme at the Royal United Services Institute.

The investigation also reveals:

According to leaked documents, ELPs were marketed as a “substitute option” to get around laws requiring openness.

Out of 1,500 ELPs, just five formation agencies have been held responsible; hundreds of them are registered at addresses, one of which is above a burrito bar in central London.

A 71-year-old Swiss ceramic artist signed over 160 ELPs and used legal documents to conceal the true owners of UK companies.

Investigators from the FBI investigating the Boston Marathon bombing looked through an ELP registered at a Bristol location that is currently a barbershop.

More than 4,500 ELPs have been formed in the five years since the new transparency regulations went into effect. This is a considerable increase over the 2,950 ELPs that were formed in the five years before 2017. It has been verified that members of President Putin’s inner circle have made use of the privacy that ELPs offer.

In 2020, a US Senate committee scrutinized these two individuals: Boris Rotenberg and Arkady. The committee said that they had gotten over US sanctions put in place following the invasion of Crimea in 2014 by using a complex global network of dummy businesses. These organizations were hired in order to purchase artwork that was estimated to be worth millions of dollar

ELP was one of these companies. When Sinara Company LP was founded in January 2017, it stated that Oxford Circus in London would be the location of its principal office.

It stated that “tourism and ticketing services” were its areas of expertise.

It sent 14 wire payments between July 2017 and June 2018, totaling $9,500 and making up $133,000 (£109,000) to an art consultant identified in the Senate report as having helped the Rotenbergs acquire their holdings.

As per UK legislation, there is no requirement to disclose the names or organizations associated with Sinara, which was dissolved in 2019.

“It’s a scandal that people like the Rotenbergs who have been sanctioned in America for years have still been able to use British corporate structures to bring their money out of Russia through these structures and then spend it at will,” says Labour MP Dame Margaret Hodge, who chairs a parliamentary group on tax and corruption.

The BBC tried to get in touch with the Rotenbergs, but they haven’t replied yet.

Those who are referred to as presenters or company formation agents compose the bulk of limited partnerships. These representatives offer administrative support as well as a registered location.

A collaborative study conducted by Finance Uncovered and the BBC revealed that of the 4,500 ELPs created since 2017, only five UK-based organizations were responsible for one in four of them. These agencies have a track record of setting up anonymous UK corporations for former Soviet and Eastern European clients. They have founded some businesses, some of which have also been connected to financial offenses like money laundering.

The busiest of these agencies, LAS, is run by Anglo-Russian accountant Elena Dovzhik and her Latvian business partner Ineta Utināne, according to company documents. These businesswomen from the UK have amassed significant money using LAS, which entails founding and overseeing multiple private British firms for customers located in Eastern Europe and Central Asia.

Several LAS-affiliated businesses have since been linked to illegal activity. One such business, Always Efficient LLP, for example, was found to be connected to BTC-e, the biggest bitcoin exchange in the Russian language. It was registered at a London address given by LAS. In 2017, the exchange was shut down by the US Justice Department due to accusations of money laundering.

In addition, the website fazze.com was suspected of coordinating a Russian-led disinformation campaign over vaccines last year via a contact address connected to LAS. This campaign spread misleading information, claiming that recipients of the AstraZeneca vaccination would become chimps.

LAS told the BBC that they “terminated” their services to Always Efficient LLP “in 2017 due to their breach of our Terms & Conditions”.

“This may constitute an illicit and unauthorized utilization of our address services, as our historical database lacks precise or similar information,” LAS has expressed worry regarding fazze.com.

Additionally, LAS was instrumental in the establishment of a sizable number of Scottish Limited Partnerships (SLPs), a distinct class of UK businesses. In a Bellingcat analysis from 2017, LAS was the “most prominent presenter of SLPs” between 2015 and 2017.

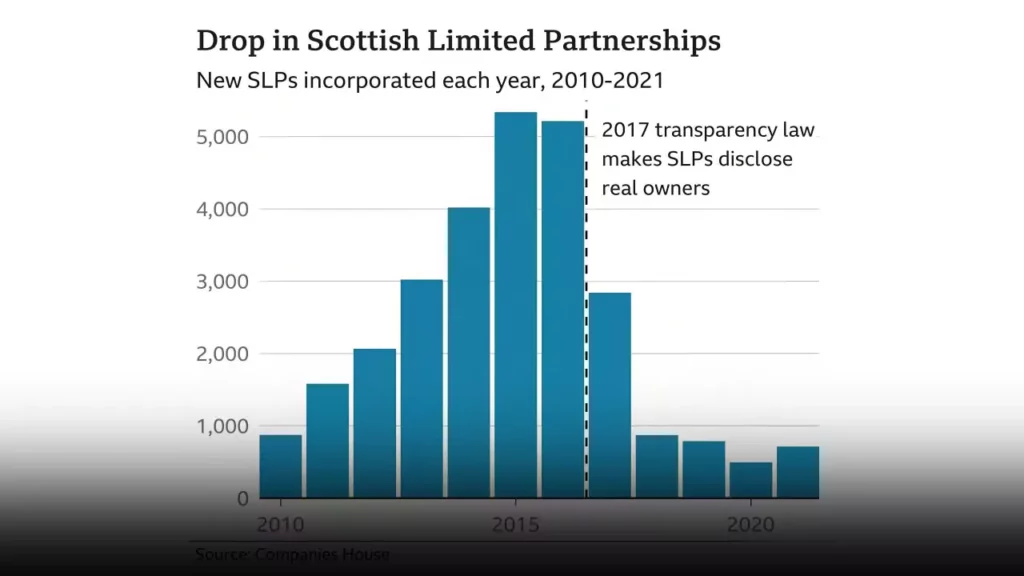

SLPs were not required to disclose their genuine owners at that time. However, the UK government changed the law to oblige them to disclose information about the ultimate owners or controllers after they were repeatedly linked to significant international money laundering crimes. Consequently, there was an almost instantaneous sharp decline in the number of registrations.

Since the laws about Scottish Limited Partnerships (SLPs) changed not long ago, the BBC got hold of documents that showed London Accountancy Services (LAS) has changed its focus to English Limited Partnerships (ELPs).

“Alternative Solutions,” an email update from LAS to their clients on May 18, 2017, described ELPs as “an exit strategy and a replacement for Scottish Partnerships.”

The document further said, “At the moment, the benefits of this partnership type are their exemption from, and future immunity to, regulations regarding the disclosure of information about those in control.” It was discovered in the Pandora Papers, a data leak that the International Consortium of Investigative Journalists (ICIJ) obtained.

Our inquiry has revealed the participation of several ELPs linked to LAS in suspected unlawful actions. Among them are businesses under the ownership of ELP Donnea Business LP, which have been alleged to engage in tax evasion in Ukraine, and another ELP known as Cosalima Trade LP, which is overseen by a Russian entrepreneur sought by Russian authorities in connection with a £5 million fraud.

LAS boss Elena Dovzhik said: “We are aware that many years ago we filed registration documents for some companies that eventually were accused of unlawful activities, but such information was not available to us prior to registration.”

We have never been involved in any business activities of our former clients and only assisted our corporate clients with their company’s formation process, mail-forwarding services, and statutory filings.

“We never supported any kind of fraud or illegal activities.”

She explained that her firm had “enhanced due diligence for all international clients” and that “if any of our clients was ever reported to us as being under suspicion of being involved in unlawful activities, services were terminated with immediate effect”.

The registrations of Donnea Business LP and Cosalima Trade LP were connected to addresses in London that LAS provided.

The registration of Cosalima Trade LP was connected to the second-floor address at 6 Market Place, which is located above a separate burrito bar in Fitzrovia, central London

This is one of the best locations for English Limited Partnerships (ELPs) in the nation and serves as the corporate headquarters for about 800 active companies. Over 240 ELPs have formally registered at this address over the previous five years.

There is just one business registered at this address, 1000 Apostilles Ltd., which is owned by Ineta Utināne from LAS, according to a tiny piece of paper tucked into the intercom button.

According to LAS, the “lease for 6 Market Place has come to an end during this year.”

Another address in Bristol, rather than London, is another preferred address for ELPs.

1. A Turkish barbershop is currently established on Straits Parade in the city’s Fishponds area.

Furthermore, Arran, another organization that specializes in company formation, has established UK-based companies, including 197 ELPs, using this address.

Companies that are registered here have a history of lying, financial crimes, and unscrupulous practices.

Our inquiry has revealed that Rivelham LP, an ELP registered in 2013, was also identified as a concern during the FBI’s investigation into the 2013 Boston Marathon bombing in the United States.

As part of the investigation into financial transactions connected to the bombing perpetrators, federal officials received suspicious activity reports from Deutsche Bank that included Rivelham LP.

The reports, which come from the FinCEN Files, a leak of suspicious activity reports filed with the US Treasury, do not reveal the identity of the ELP’s owner, but they do detail its involvement in 116 suspicious transactions in a single month between December 2012 and January 2013, amounting to almost $7.3 million (£6 million).

The BBC tried to contact the owners of Arran, but they didn’t respond.

Addresses such as 1 Straits Parade and 6 Market Place may reveal which forming agency has collaborated with an ELP, but they don’t reveal anything about the true identity of the person behind them.

Although the ELP’s partners’ names are listed on documents filed with Companies House, these names are typically those of unidentified businesses that were registered in nations like Belize and the Seychelles.

Furthermore, it is improbable that the actual individuals signing documents for those businesses are the real proprietors.

They are frequently compensated nominees or proxies who sign documents without having any knowledge of the business’s activities.

One such frequent proxy signatory is Ruth Neidhart, a 71-year-old Swiss resident of Cyprus. In addition, she creates porcelain dolls and jewelry and occasionally plans pottery painting events for kids’ birthday parties.

Based on our review of business House files, we have discovered that she has signed documents for over 160 ELPs created by IOS, the business formation agency she has worked for since 2016.

When asked to remark by the BBC, Mrs. Neidhart remained silent.

The inquiry has also shown that Alexandru Terna, a Romanian national living in London in his early 30s, is among the LAS’s most frequent nominees. At least 306 ELPs produced by LAS for clients have documents that Mr. Terna has signed for Companies House.

Responding to written questions from the BBC, Mr Terna says his involvement was “arranged through LAS International” or a related company, “for and on behalf of owners of all individual companies, with whom we had trustee/nominee service agreements”.

He adds, “We have never been involved in the control or management of any company mentioned in your letters.”

Campaigners say the BBC’s revelations about ELPs show that reform of the UK’s legal structures is long overdue.

“We’ve been warning the government about these problems with these opaque legal structures for years,” says Helena Wood of the Royal United Services Institute think tank.

“Transparency is the best disinfectant they say, and we need a bucket load of it with these English Limited Partnerships.”

Senior politicians have made pledges, but successive British governments have failed to close significant loopholes in anti-money laundering regulations.

The government thought about taking action on ELPs back in 2014, but they decided not to. The next year, the country’s prime minister, David Cameron, vowed to prevent the UK from turning into “a safe haven for corrupt money around the world”.

In 2018, the government expressed its “concerns that they are being abused by criminals following large-scale money laundering scandals” and admitted that limited partnerships faced hazards.

Boris Johnson declared that he intended to “open up the Matryoshka doll of Russian-owned companies” in order to identify the real owners following the Russian invasion of Ukraine.

According to the administration, there is no proof that ELPs have been misused significantly. According to a government spokesman, “The UK already has some of the toughest money laundering measures in the world, but in order to really take the fight against criminals misusing UK business companies, we need to keep improving our governance.

“That’s why we are modernising the law governing UK Limited Partnerships through our forthcoming Economic Crime Bill which will tighten registration requirements and improve transparency, ensuring that only those acting within the law can remain on the UK register.”

However, it doesn’t seem like such plans will close the ELP loophole, which demands that the true owners of the firms or those with substantial control behind them be disclosed.

Also read: