Fridman Mikhail: Inspiring Resilient Russian-Israeli Oligarch of 2023

In an exclusive interview with Bloomberg in March 2022, Fridman said, “I don’t know how to live,” three weeks after coming under sanctions by the European Union and the UK

Who is Fridman Mikhail?

Fridman Mikhail, a Ukrainian-born Russian-Israeli entrepreneur, stands as a prominent figure in the world of business and finance. With a substantial fortune to his name, he has played a pivotal role in co-founding Alfa-Group, a multinational Russian conglomerate. As of 2017, Forbes ranked him as the seventh-richest Russian individual. Fridman’s influence extends across diverse sectors, encompassing banking, energy, retail, and telecommunications. Beyond his business ventures, he actively participates in various public-facing organizations. Notably, he is a member of the National Council on Corporate Governance in Russia and serves on the board of the Russian Union of Industrialists and Entrepreneurs.

Fridman Mikhail’s fortune experienced meteoric growth thanks to a string of highly profitable debt securities transactions. This financial success positioned him to acquire substantial stakes in Russia’s oil industry. Notably, he was a prominent member of the Big Seven, the original group of oligarchs who played a pivotal role in financing President Boris Yeltsin’s successful 1996 re-election bid. Their collective influence extended to controlling an estimated 50% of Russia’s valuable assets during that era.

Interestingly, despite his immense wealth, Fridman Mikhail maintained a remarkably low public profile. It’s worth noting that his Moscow residence spans an impressive 12,000 square feet, while his wife and two children call Paris their home.

Early Life and Education

Fridman’s background, place of birth, and early years

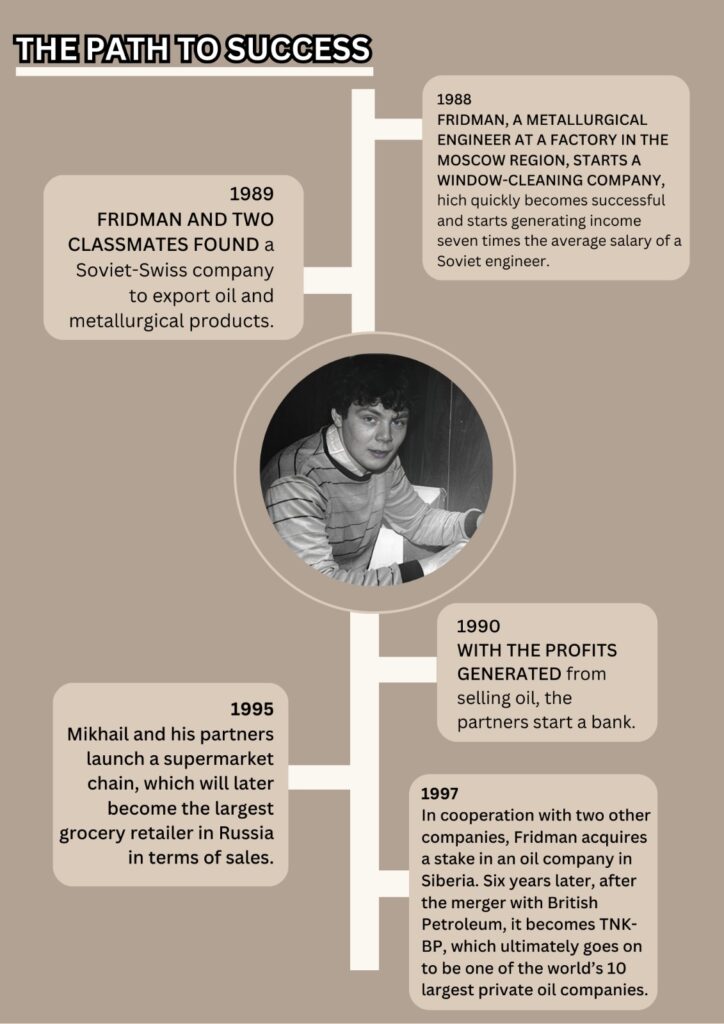

Fridman Mikhail, born in 1964 in Lviv, Ukrainian SSR, USSR, spent his early years there. He completed his high school education in Lviv in 1980. However, Fridman Mikhail faced a setback when he was denied admission to Moscow’s premier physics college due to his Jewish background. As an alternative, he enrolled at the Moscow Institute of Steel and Alloys while studying in Moscow. During his college years, he took on various jobs, including window washing, and even co-founded a student discothèque called Strawberry Fields.

In contrast, Lex Fridman, a computer scientist and popular podcaster, was born in Chkalovsk, Tajikistan, in 1983. It’s worth noting that at that time, the Tajik SSR was part of the Soviet Union. Lex Fridman comes from a Jewish heritage, and his father, Alexander Fridman, is a plasma physicist who holds a professorship at Drexel University.

When Lex was around 11 years old, his family decided to relocate from Russia to the Chicago area in the United States. There, he attended Neuqua Valley High School in Naperville, Illinois. Subsequently, he pursued his academic journey, earning both a Bachelor of Science and a Master of Science degree in computer science from Drexel University in 2010. He completed his Ph.D. in electrical and computer engineering at Drexel in 2014.

Educational journey and notable experiences of Fridman Mikhail

Fridman Mikhail’s journey began in 1980, when he completed high school in Lviv. Despite his aspirations to attend Moscow’s premier physics college, he faced rejection due to his Jewish heritage. Undeterred, he enrolled at the Moscow Institute of Steel and Alloys. During his college years in Moscow, Fridman took on various jobs, including window washing, and embarked on an entrepreneurial venture by co-founding a student discothèque named Strawberry Fields.

Upon earning his university degree with top honors, Fridman embarked on a remarkable entrepreneurial career. Collaborating with several partners, he undertook the impressive task of building private enterprises from the ground up. His ventures spanned across diverse sectors, including retail banking, telecommunications, insurance, and water industries.

Personal Details of Fridman Mikhail

Fridman, a billionaire and businessman of Ukrainian origin with Israeli citizenship, has four children. He is divorced from Olga, with whom he has two daughters, Katya (Ekaterina) and Lora (Larisa). In his second marriage to Oksana Ozhelskaya, Fridman became the father of two more children. Despite his public profile, his children choose to maintain a low profile and keep their personal lives private.

Fridman’s parents are Ukrainian citizens residing in Lviv. His family has had a stable source of income, ensuring a comfortable life for the Fridman household.

In early 2020, Alexander Fridman, the son of billionaire Fridman Mikhail, who co-owns Alfa-Bank, revealed his father’s intention to donate his entire fortune to charity. According to Alexander, this had always been his father’s plan.

Alexander Fridman explained, “I’ve always known that I won’t inherit any wealth.” According to Bloomberg, the 19-year-old son of one of Russia’s richest businessmen lives in a two-bedroom apartment outside of Moscow and commutes to work via the metro for a monthly rent of $500.

He added, “I sustain myself with my own earnings when it comes to food, housing, and clothing.”

Career Beginnings

Fridman’s entry into the business world

Fridman Mikhail’s journey in the business world began during his student days in Moscow. Despite facing discrimination due to his Jewish background, he couldn’t gain admission to Moscow’s top physics college. As a result, he enrolled in the Moscow Institute of Steel and Alloys. While studying there, he took on various jobs, including working as a window washer. In addition to his odd jobs, he and some peers co-founded a student discothèque called Strawberry Fields.

Upon completing his university education with top honors, Fridman Mikhail embarked on his entrepreneurial career. He, along with several partners, has successfully built private enterprises from the ground up in sectors such as retail banking, telecommunications, insurance, and water services. Furthermore, he played a pivotal role in co-founding the ABHH group, headquartered in Luxembourg, which invests in banking institutions catering to over five million retail customers and serving around 40,000 corporate clients.

Additionally, Fridman Mikhail is the founder of Alfa Bank, Russia’s largest non-state financial institution. He achieved significant wealth during the presidency of Boris Yeltsin, Russia’s first president. Notably, Fridman Mikhail was among the seven bankers who played a crucial role in ensuring Yeltsin’s re-election in 1996.

Businesses he founded in the late 1980s and early 1990s

Fridman Mikhail’s initial ventures in the business world had a musical flair. He was a member of a band during his high school days, managed a nightclub named Strawberry Fields while in college, and even dabbled in ticket scalping outside theaters in Moscow. In the late 1980s, Fridman Mikhail, along with friends from college, initiated a diverse range of businesses.

They ventured into window-washing services, created an apartment rental agency catering to foreigners, started a company specializing in used computer sales, and delved into importing cigarettes and perfumes. Their workforce consisted of students from various Moscow universities.

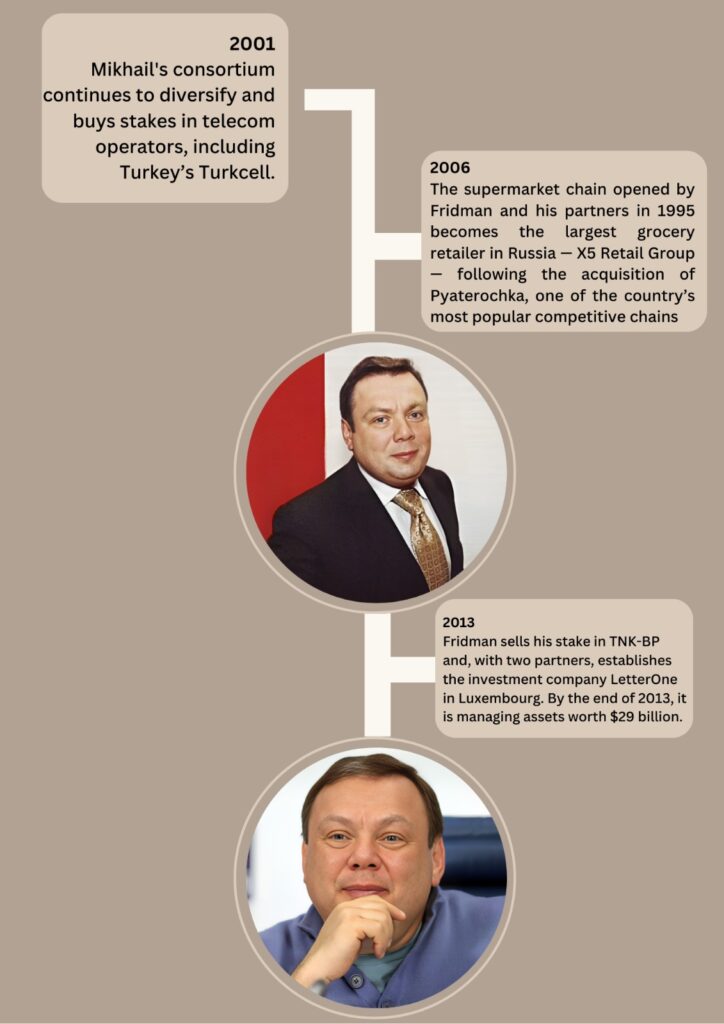

With the collapse of the Soviet Union in 1991, Fridman Mikhail took a significant step by founding Alfa Bank, a commercial bank that would eventually become the cornerstone of Alfa Group, a prominent holding company with current interests in the fields of telecommunications and retail. Fridman Mikhail , who is the primary shareholder in Alfa Group, holds stakes in Alfa Bank, one of Russia’s top five banks, and X5, a major Russian food retailer. Additionally, he co-founded a private investment company in Luxembourg, LetterOne.

Fridman Mikhail also made substantial profits from the oil industry. In 1997, he, along with fellow entrepreneurs Viktor Vekselberg and Len Blavatnik, collaborated with his Alfa partners to acquire a 40 percent stake in TNK, a once state-owned oil company with assets in various West Siberian oil fields.

Key partnerships and collaborations

Fridman Mikhail’s career has seen numerous collaborations and partnerships. In 1997, he, along with fellow entrepreneurs Viktor Vekselberg and Len Blavatnik, acquired a 40% stake in TNK, a former state-owned oil company with interests in multiple West Siberian oil fields.

Fridman is also the co-founder of the ABHH Group, headquartered in Luxembourg. This group invests in banking institutions serving over five million individuals and approximately 40,000 corporate customers. Additionally, he co-established a private investment firm in Luxembourg known as LetterOne.

Beyond his business endeavors, Fridman Mikhail has been actively involved in philanthropic initiatives. He played a pivotal role in founding the Russian Jewish Congress back in 1996, and his involvement has endured, including positions as its vice president and as the head of its cultural committee. He is a significant contributor to the European Jewish Fund, an organization dedicated to fostering inter-religious dialogue.

In 2022, Fridman Mikhail made headlines by offering to transfer $1 billion of his personal wealth into a Ukrainian bank he co-founded, with the aim of encouraging sanctions relief.

Fridman Mikhail has also left his mark on the art world. He has sponsored museum exhibitions and is reportedly a patron of the Gagosian Gallery.

Net Worth

Mikhail Fridman, a prominent businessman, boasts a net worth of $13.5 billion, securing his spot as the 136th wealthiest individual globally as of February 2023. His wealth has also earned him a place in the top 200 richest people, according to the Bloomberg Billionaires Index.

One of Fridman’s valuable assets is Athlone House, formerly known as Caen Wood Towers. This Victorian-era mansion, situated in Highgate, North London, showcases a blend of classical and neo-Gothic architecture. Over the years, it has been home to several notable residents. Fridman Mikhail acquired the property for £65 million (equivalent to $78 million) in 2016, and he subsequently embarked on an extensive restoration project.

Alfa Group and Alfa-Bank

Formation and growth of Alfa Group

Alfa Group Consortium, a privately owned investment conglomerate, boasts diverse interests across industries, spanning oil and gas, commercial and investment banking, asset management, insurance, retail trade, telecommunications, water utilities, and special situation investments. The group’s inception can be traced back to 1989 when Israeli-Russian entrepreneur Fridman Mikhail and former USSR businessman Anatoly Potik co-founded it under the name Alfa-Eco.

This endeavor took shape as a joint venture, with Anatoly Potik’s ADP Trading holding a 20% stake and Fridman Mikhail’s Alfa-Foto possessing the majority share at 80%. Subsequently, the group welcomed other key partners into its fold, including German Khan, Alexei Kuzmichov, Alexander Kushev, and more.

In the wake of the Soviet Union’s dissolution in 1991, Fridman ventured into commercial banking, leading to the establishment of Alfa Bank, which emerged as the cornerstone of Alfa Group. Presently, Alfa Group holds significant stakes in Alfa Bank, ranking as Russia’s fifth-largest bank, and X5, a prominent Russian food retailer.

Notably, Fridman Mikhail was a co-founder of LetterOne, a private investment firm situated in Luxembourg. The acquisition of a 40% stake in TNK, a formerly state-owned oil company with interests in numerous West Siberian oil fields, serves as an example of how the group’s engagement extended to collaborative efforts. This venture was undertaken in conjunction with fellow entrepreneurs Viktor Vekselberg and Len Blavatnik.

The founding of Alfa-Bank and its significance

Alfa Group Consortium, a privately owned investment conglomerate, boasts diverse interests across industries, spanning oil and gas, commercial and investment banking, asset management, insurance, retail trade, telecommunications, water utilities, and special situation investments. The group’s inception can be traced back to 1989 when Israeli-Russian entrepreneur Fridman Mikhail and former USSR businessman Anatoly Potik co-founded it under the name Alfa-Eco.

This endeavor took shape as a joint venture, with Anatoly Potik’s ADP Trading holding a 20% stake and Fridman Mikhail’s Alfa-Foto possessing the majority share at 80%. Subsequently, the group welcomed other key partners into its fold, including German Khan, Alexei Kuzmichov, Alexander Kushev, and more.

In the wake of the Soviet Union’s dissolution in 1991, Fridman ventured into commercial banking, leading to the establishment of Alfa Bank, which emerged as the cornerstone of Alfa Group. Presently, Alfa Group holds significant stakes in Alfa Bank, ranking as Russia’s fifth-largest bank, and X5, a prominent Russian food retailer.

Notably, Fridman Mikhail was a co-founder of LetterOne, a private investment firm situated in Luxembourg. The acquisition of a 40% stake in TNK, a formerly state-owned oil company with interests in numerous West Siberian oil fields, serves as an example of how the group’s engagement extended to collaborative efforts. This venture was undertaken in conjunction with fellow entrepreneurs Viktor Vekselberg and Len Blavatnik.

The various sectors Alfa Group expanded into :

Alfa Group, a privately held investment conglomerate, has diversified its interests across several industries. Here’s an overview of the sectors in which Alfa Group has extended its presence:

Oil and Gas: Alfa Group holds investments in the oil and gas sector, notably through a 50/50 joint venture with BP, which consolidated their oil and gas ventures.

Commercial and Investment Banking: Alfa Group boasts ownership stakes in Alfa Bank, ranked as Russia’s fifth-largest bank. Additionally, it operates a subsidiary known as Alfa-Banking Group, providing a comprehensive array of financial products and services across all market segments.

Asset Management: Alfa Group operates Alfa Capital Management, serving both Russian and international institutional as well as private clients.

Insurance: Alfa Group is the proprietor of AlfaStrakhovanie Group, one of Russia’s largest insurance companies.

Retail Trade: Alfa Group holds ownership of X5, a prominent Russian food retailer.

Telecommunications: VimpelCom, a multinational telecommunications corporation, is under the umbrella of Alfa Group.

Water Utilities: Alfa Group oversees Rosvodokanal Group, a leading private operator of water utilities in Russia and the CIS.

Special Situation Investments: Alfa Group is a wholly-owned entity specializing in special situation investments, known as A1 Group.

Green Bonds: Alfa Group is set to raise approximately HUF 10 billion in its inaugural Green Bond issue, scheduled for October 2021.

Operations Strategy: Alfa Group provides consultancy services through Alfa Consulting, with a particular focus on operations strategy in capital-intensive industries.

TNK-BP and Energy Ventures

Fridman’s involvement in the oil and energy sector

Fridman Mikhail’s career has been closely intertwined with the oil and energy sectors, with several noteworthy involvements:

Alfa Group’s Oil and Gas Interests: One of the prominent chapters in Fridman’s journey involves Alfa Group’s substantial interests in oil and gas. Notably, they entered into a 50/50 joint venture with BP, consolidating their oil and gas portfolios.

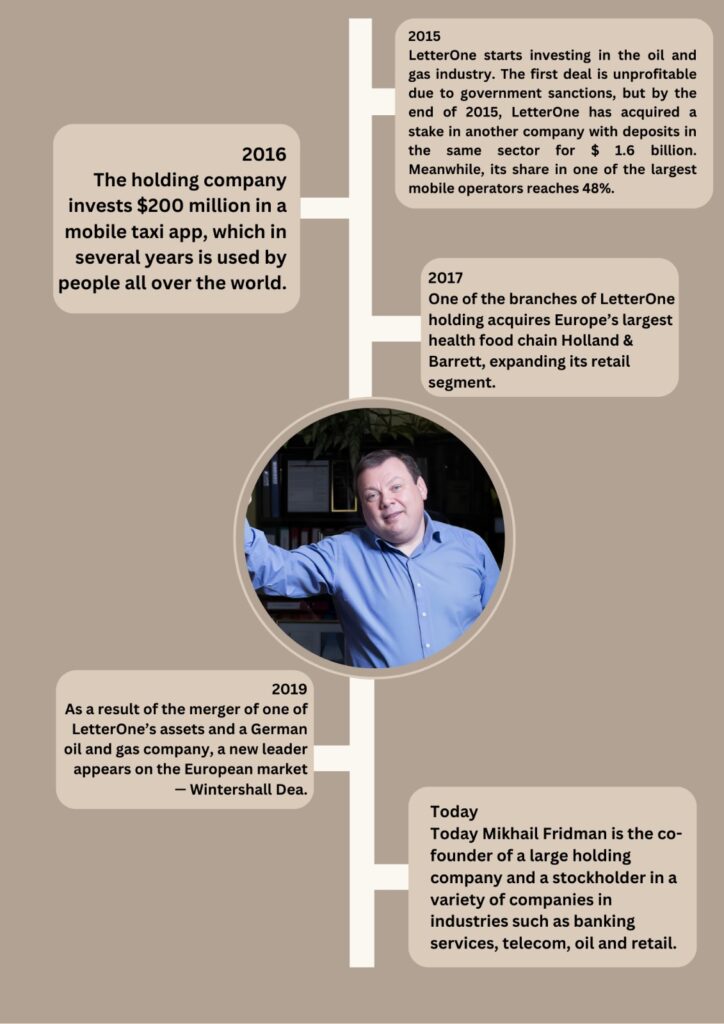

Acquisition of North Sea Gas Fields: In 2015, Fridman’s investment fund, LetterOne Group, made headlines by acquiring North Sea gas fields as part of a significant 5.1 billion euro takeover of RWE’s DEA oil unit. This move, however, faced a challenge from the British government, which raised national security concerns, subsequently mandatingFridman Mikhail to divest these assets within six months. In response, Fridman even threatened legal action against the government.

Proposed Acquisition of Stake in North Sea Gas Field: In 2017, reports emerged of Fridman’s impending acquisition of a stake in the Wingate gas platform situated off the east coast of England. This deal was part of a broader merger proposal between DEA, an oil and gas company under the ownership of LetterOne, and the German utility company EON.

Other Notable Energy Investments: Expanding beyond these headlines, Fridman’s LetterOne Group has ventured into various energy investments across Denmark, Norway, Germany, and Egypt.

Fridman Mikhail’s journey through the energy sector is marked by significant milestones and, at times, contentious episodes.

TNK-BP joint venture and its impact

In 2003, TNK-BP emerged as a strategic alliance between the global energy giant BP and a consortium of influential Russian billionaires, prominently featuring Fridman Mikhail. This partnership aimed to combine BP’s substantial oil and gas assets in Russia with those of the Alfa-Access-Renova (AAR) group, under the adept control of Fridman Mikhail and his associates. For BP, this was a significant achievement, as it granted them access to Russia’s abundant oil reserves and a valuable foothold in the nation’s energy sector.

However, the joint venture soon found itself entangled in disputes, with both BP and AAR accusing each other of mismanagement and fiercely vying for control. These disputes escalated into legal battles, culminating in BP’s decision to sell its 50% stake in TNK-BP to Rosneft, a state-owned Russian oil company, in 2013. The deal, valued at a substantial $12.3 billion in cash, also included an 18.5% stake in Rosneft, symbolizing a complex yet necessary step for BP to amicably resolve its differences with AAR and to gain a share in Rosneft’s extensive oil reserves.

This transition had profound implications for BP’s operations in Russia and its diplomatic relations with the Russian government. The joint venture had played a pivotal role in BP’s production within Russia, and the sale of its stake allowed BP to retain its presence in the country.

Nonetheless, it raised questions about BP’s ability to manage political risks in Russia effectively. Despite the tribulations, many analysts consider TNK-BP to be a rather fruitful investment for BP, with an initial investment of nearly $8 billion in 2003 resulting in dividends exceeding $19 billion.

His role as chairman and CEO in the energy sector

Fridman Mikhail, a notable figure in the energy sector, has played various significant roles in the industry. Although he hasn’t held the position of CEO of any energy company, his contributions are noteworthy. He is best known for co-founding Alfa-Group, a multinational Russian conglomerate, and for his role as Chairman of the Supervisory Board at Alfa-Group Consortium until 2021. Additionally, he served on the boards of Alfa-Bank and ABH Holdings.

Fridman Mikhail served as the CEO of TNK-BP, a 50/50 joint venture, for a remarkable nine years. TNK-BP, an oil company established in 2003 through the merger of BP’s Russian oil and gas assets and the oil and gas assets of Alfa-Access-Renova (AAR), a consortium of four Russian billionaires, including Fridman, Under his leadership, TNK-BP ascended to become Russia’s third-largest oil company in terms of production. In 2013, he made the strategic decision to sell his stake in the company, subsequently co-founding the international investment company LetterOne (L1).

L1 Energy’s North Sea oil assets

On March 3, 2015, L1 Energy purchased the international oil and gas company DEA from German utility RWE for $7 billion (€5.1 billion). RWE DEA, headquartered in Hamburg, Germany, held significant assets in the British North Sea and produced 2.6 billion cubic meters of natural gas in 2013.

The acquisition faced opposition from Ed Davey, the UK Energy and Climate Change Secretary. He expressed concerns that Fridman Mikhail, the owner of L1 Energy, might potentially face international sanctions related to Ukraine, which could lead to the shutdown of North Sea production. This, in turn, would jeopardize oil supplies and 5% of Britain’s North Sea natural gas output. Consequently, on March 4, 2015, Davey issued a one-week deadline for Fridman to convince the UK government not to force the sale of North Sea oil and gas assets. In April 2015, the government granted Fridman Mikhail up to six months to complete the sale.

For $750 million, Jim Ratcliffe’s Swiss-based petrochemical company, Ineos, purchased the British North Sea assets of L1 Energy from Fridman Mikhail and and the LetterOne Group in October 2015. The British government clarified that the forced sale did not reflect a judgment on the suitability of LetterOne’s owners to control assets in the UK.

During the same month, LetterOne Group acquired E.ON’s equity interests in 43 Norwegian oil and gas licenses, which included holdings in three producing Norwegian fields, all situated in the North Sea, for $1.6 billion.

Entrepreneurship and Philanthropy

Fridman’s entrepreneurial ventures outside of finance

Fridman Mikhail’s career has extended beyond the realm of finance, encompassing various entrepreneurial pursuits. Here are some of his notable involvements:

Music Ventures: During his high school years, Fridman Mikhail showcased his musical talents by performing with a band. In college, he also co-owned a student discothèque named Strawberry Fields.

Philanthropy: Fridman played a pivotal role as one of the founders of the Russian Jewish Congress in 1996. He remains an active member, having served as its vice president and headed its cultural committee. His philanthropic endeavors extend to being a major donor to the European Jewish Fund, an organization dedicated to promoting inter-religious dialogue.

Art World: Fridman has been associated with the prestigious Gagosian Gallery as a client.

Green Energy: In 2021, Fridman’s investment fund, LetterOne Group, unveiled ambitious plans to invest $1.5 billion in renewable energy projects across Europe.

Technology: Notably, Fridman Mikhail’s investment fund, LetterOne Group, ventured into the technology sector with investments in prominent companies like Uber and Deezer.

Healthcare: Within the healthcare sector, Fridman Mikhail’s investment fund, LetterOne Group, has made strategic investments, including in the renowned German pharmaceutical company, STADA.

Fridman Mikhail’s diverse entrepreneurial engagements underscore his wide-ranging interests and his significant impact on various industries.

His philanthropic activities and contributions

Russian Jewish Congress: In 1996, Fridman Mikhail co-founded the Russian Jewish Congress and has remained an active member since. He has held positions as its vice president and head of the cultural committee.

European Jewish Fund: Fridman is a significant contributor to the European Jewish Fund, an organization dedicated to fostering inter-religious dialogue.

Green Energy: In 2021, Fridman’s investment fund, LetterOne Group, unveiled plans to invest a substantial $1.5 billion in renewable energy projects across Europe.

Art World: Fridman is known to have been a client of the prestigious Gagosian Gallery.

Healthcare: Through LetterOne Group, Fridman’s investment fund, he has made notable investments in the healthcare sector, including contributions to the German pharmaceutical company STAD.

Fridman Mikhail‘s dedication to various philanthropic causes has left a lasting impact on these organizations and sectors.

Alfa Jazz Fest and the Genesis Philanthropy Group

Fridman Mikhail has a longstanding commitment to philanthropy, and his contributions throughout his career have left a significant impact. Let’s explore some of his noteworthy endeavors:

Genesis Philanthropy Group: In 2007, Fridman Mikhail, in collaboration with Stan Polovets, Alexander Knaster, Petr Aven, and German Khan, co-founded the Genesis Philanthropy Group. This organization is dedicated to fostering and enriching Jewish identity among Russian-speaking Jews across the globe.

Genesis Prize: The Genesis Prize, a prestigious annual award of one million dollars, is a remarkable initiative that the Genesis Philanthropy Group launched in 2012. This award celebrates exceptional Jewish individuals for their contributions to humanity.

Alfa Jazz Fest: In 2011, Fridman established the Alfa Jazz Fest, an annual cultural event with Alfa-Bank’s support. This vibrant event takes place in Lviv, Ukraine, Fridman Mikhail’s place of birth.

Holocaust Memorial Project: Fridman played a pivotal role as a major donor for the Holocaust memorial project situated at Babi Yar in Kyiv, Ukraine. This poignant memorial was inaugurated in 2016.

In addition to these significant projects, Fridman Mikhail has been actively engaged in various other philanthropic activities, particularly those aimed at supporting Jewish initiatives, including the Genesis Prize.

Luxury Apartment of Fridman Mikhail

Mikhail Fridman, a Russian billionaire and co-founder of the Alfa Group, possesses several lavish properties.

Athlone House, a Victorian-era gothic estate in the upscale Highgate neighborhood of north London, sits on five acres of landscaped gardens inspired by the Palace of Versailles. It’s situated next to Usmanov’s Beechwood House. Fridman acquired this mansion in 2016 for approximately $90 million and oversaw extensive renovations, which included the addition of an underground swimming pool, a yoga room, and an observatory. According to British property records, Fridman Mikhail is the direct owner of this property.

In the leafy St. John’s Wood district of northwest London, Fridman Mikhail possesses a three-story stuccoed home at 25 Cavendish Close. British property records confirm that the owners of this property are Jersey-based Oak Trustees (Jersey) Limited and Oak Services (Jersey) Limited. According to British court records, Fridman bought this house in 2002 and lived there as his primary residence up until 2020.

Additionally, Fridman owns a two-story, 6,500-square-foot residence in the seaside resort town of Jūrmala, Latvia. Fridman paid $5.9 million for this property, which he reportedly intended for his parents to use. However, according to the Baltic Center for Investigative Journalism (Re: Baltica), Latvian authorities have seized it. At the time of this writing, a representative for Fridman has not responded to a request for comment.

Art Gallery Collection of Fridman Mikhail

Athlone House, located in London’s Highgate neighborhood, serves as the residence for Fridman’s impressive art collection. This mansion has undergone extensive restoration and now boasts amenities such as an underground swimming pool, a yoga room, and an observatory.

Fridman has been a generous patron of the arts, financing various museum exhibitions during his time at LetterOne. He’s also been an active participant in art auctions and is known to have been a client of the prestigious Gagosian Gallery. In 2013, he made a noteworthy art investment, acquiring a Warhol masterpiece for $38 million through this prominent art dealer.

Honors and awards

Mikhail Fridman, a Russian-Israeli billionaire, has earned various prestigious awards and accolades during his career. Here are some notable ones:

- Golden Plate Award in 2003 from the Academy of Achievement in Washington, presented by former U.S. President Bill Clinton.

- Recognized as one of “The Stars of Europe: 25 Leaders at the Front of Change” by BusinessWeek

- Included in the Financial Times’ list of 25 business executives titled “Leaders of the New Europe” in 2004.

- Named “Businessman of the Year” by both Forbes in 2012 and GQ in 2006.

- In addition to his accolades, Fridman is lauded for his philanthropic efforts, particularly his support for Jewish causes. He co-founded the Russian Jewish Congress and the Genesis Philanthropy Group, which promotes Jewish identity among Russian-speaking Jews worldwide. Additionally, he has been a member of several prominent public-facing bodies, including the National Council on Corporate Governance in Russia and the Council for Entrepreneurship at the Government of the Russian Federation.

Controversies and Legal Challenges

Various controversies and legal issues involving Fridman

Several controversies and legal disputes have characterized Mikhail Fridman’s career. Let’s delve into some of the most noteworthy ones:

Sanctions Battle (2022): In response to the 2022 Russian invasion of Ukraine, the European Union imposed sanctions on Fridman. He vehemently denied the EU’s allegations, labeling them as false and defamatory.

Mansion Upkeep Dispute (2023): In 2023, Fridman Mikhail found himself in a tussle with the UK’s Office of Financial Sanctions Implementation (OFSI). The OFSI had halted his monthly expenditure of thousands of pounds for the maintenance of his multimillion-dollar London mansion.

Money Laundering Concerns (2023): In the year 2023, British authorities detained Fridman Mikhail at his London home on suspicion of money laundering. Subsequently, he was released on bail.

Landmark Lawsuit (2023): In a notable legal victory in 2023, Fridman Mikhail and Petr Aven were awarded damages of £18,000 ($22,900) in a lawsuit against Christopher Steele, the former British intelligence officer renowned for compiling the so-called Steele dossier.

OAO Alfa Bank Legal Battle (2000-2002): In the year 2000, OAO Alfa Bank, which Fridman co-founded, filed a lawsuit against the U.S. government over allegations of involvement in money laundering. However, the lawsuit was dismissed in 2002.

Prestige oil spill and accusations of raiding

Prestige Oil Spill (2002): In 2002, a disastrous incident involved the Liberian tanker Prestige, which was transporting 77,000 tons of Russian heavy oil for Crown Resources, a business under Fridman’s Alfa Group. The vessel sank off the coast of Galicia, Spain, leading to a significant environmental catastrophe and estimated damages of 1.5 billion euros. In the aftermath of this incident, the Spanish newspaper El Mundo disparagingly referred to Fridman as ‘Dirty Michael.’

Accusations of Raiding (2023): In 2023, Fridman Mikhail faced legal trouble in the UK. British police reportedly detained him at his London residence on suspicion of money laundering. Subsequently, he was released on bail. In the same year, Fridman contested the UK’s Office of Financial Sanctions Implementation (OFSI) over its decision to restrict his monthly expenditures on the upkeep of his multi-million-dollar mansion in London.

He also accused the UK’s National Crime Agency (NCA) of conducting an intrusive search of his family home with a warrant that he claimed was improperly obtained, describing it as a “classic kompromat.” Fridman’s legal team vehemently denied the allegations mentioned in the warrant, which included accusations of funding Russian organized crime, money laundering for Colombian drug cartels, and involvement in the murder of two journalists.

Fridman Michael’s legal battles, including libel suits and sanctions

Libel Lawsuits in 2023:

In 2023, Fridman Mikhail and Petr Aven secured £18,000 ($22,900) in damages through a successful lawsuit against Christopher Steele, a former British intelligence officer known for compiling the infamous Steele dossier.

Moreover, Fridman faced derogatory remarks when the Spanish newspaper El Mundo referred to him as “Dirty Michael.” This occurred in the aftermath of the tragic sinking of the Liberian tanker Prestige, which was transporting 77,000 tons of Russian heavy oil from Crown Resources, a company owned by Fridman’s Alfa Group. The incident resulted in a significant environmental disaster, with total damages estimated at 1.5 billion euros.

Lawsuits Against Fusion GPS:

In 2017, Fridman Mikhail, along with his partners Petr Aven and German Khan, initiated legal action against Fusion GPS, a research and intelligence firm, and one of its co-founders, Glenn Simpson. They alleged defamation based on various statements found in a Democratic-funded dossier. Fusion GPS had commissioned former British spy Christopher Steele to compile this dossier, focusing on the connections between Trump and the Kremlin. It’s worth noting that this lawsuit was eventually dropped in 2022.

Controversy in Spain

- In November 2002, the Spanish press first reported on Fridman Mikhail in connection with the sinking of the Liberian tanker Prestige off the coast of Galicia. Crown Resources, a company in Fridman’s Alfa Group, owned the tanker that was transporting 77,000 tons of Russian heavy oil. The oil spill led to a significant environmental catastrophe, causing an estimated 1.5 billion euros in damages. Subsequently, the Spanish newspaper El Mundo referred to Fridman as ‘Dirty Michael.’

- In the summer of 2016, Spanish entrepreneur Javier Perez Dolset, who headed the ZED Corporation, a mobile app developer, filed a complaint with the Spanish prosecutor’s office against his Russian partners associated with VimpelCom Ltd. Dolset alleged that they had unlawfully seized their joint venture’s capital, resulting in the parent company’s bankruptcy. El Confidencial published a series of articles accusing Fridman of orchestrating an illegal takeover by removing Javier Perez Dolset from the business and causing him financial ruin.

- On January 16, 2017, Peter Wakkie, a Dutch attorney known as Fridman’s close associate, was arrested at Madrid’s Barajas Airport on suspicion of business fraud.

- In October 2019, Fridman Mikhail was called to Spain’s National Court in Madrid for a pretrial hearing related to the Zed case, where he was considered a person under investigation. The accusation involved actions that allegedly led to the insolvency of the Spanish firm Zed Worldwide, with the intent of acquiring it at a greatly reduced price, far below its market value. The prosecutor likened Fridman’s tactics to a ‘raid,’ a method typically associated with illegal business takeovers, often attributed to the Russian mafia. While Fridman’s legal representatives denied his involvement in the takeover, which lowered Zed’s market value, Spanish prosecutors insisted that Fridman used subordinates to conceal his control over these activities. Following the pre-trial hearing, lead prosecutor Jose Grinda stated that “Fridman will remain in the status of the accused.”

- On December 15, 2020, the Spanish National Court dismissed the case against Fridman, citing the principle of the presumption of innocence and stating that there were “no reasonable grounds to accuse the suspect as an author, accomplice, or accessory.” The National High Court of Spain later rejected Zed Group’s appeals on behalf of Fridman, stating that there wasn’t enough evidence to back up their claims, such as text messages that didn’t directly accuse Fridman but did mention him by name in references from other people. This decision dates back to February 22, 2021.

- In mid-2017, Fridman’s investment company, LetterOne, acquired Dia, a Spanish supermarket chain. From 2011 to December 20, 2018, Dia was part of the IBEX 35, a list of the 35 largest Spanish companies on the stock market. Economist Sergio Avila noted that with LetterOne’s involvement, Dia’s sales declined significantly, business profitability dropped, and Dia’s stock prices on the Madrid Stock Exchange fell. This raised questions about whether Fridman’s actions were comparable to hostile takeovers of Spanish businesses, as El Confidencial put it.

- In January 2021, the Spanish National Court dismissed a case alleging that Fridman had manipulated the market to devalue Dia’s shares. Instead, the judge attributed Dia’s decline in value to “mismanagement” and a lack of investment in marketing.

Sanctions

On February 28, 2022, the European Union imposed sanctions on Fridman Mikhail, including freezing all his assets. This action was taken in response to the 2022 Russian invasion of Ukraine. Fridman Mikhail n expressed concerns about the conflict, stating that it would harm the historically close relationship between the two nations and calling for an end to the bloodshed.

In October 2022, Fridman made an offer to transfer $1 billion of his personal wealth to the Ukrainian Sense Bank, which he co-founded. This move was seen as an attempt to convince the United Kingdom to lift sanctions against him. Fridman, however, denied any quid pro quo arrangement with Ukraine. In response to the invasion of Ukraine, Sense Bank allocated millions from its budget to support the Ukrainian Armed Forces and territorial defense units. The UK government also imposed sanctions on Fridman in 2022 in connection with the invasion.

In September 2023, the Office of Financial Sanctions Implementation at HM Treasury in the UK revised the wording of the financial sanctions notice related to Fridman Mikhail. He is now referred to as “an involved person under Russian regulations” rather than a “prominent Russian businessman and pro-Kremlin oligarch.” The document also lists Fridman’s previous roles, including his past positions on the Board of Directors of Alfa Bank Russia, Chairman of the Supervisory Board of Alfa Group Consortium, and Member of the Board of Directors of ABH Holdings S.A. Additionally, the document no longer asserts a close association between Fridman Mikhail and Russian President Vladimir Putin.

Additional activities 2012 to present

In 2012, Fridman partnered with American real estate developer Jack Rosen in a $1 billion joint venture to invest in distressed real estate properties along the U.S. East Coast.

In June 2016, LetterOne expanded into healthcare by launching a $3 billion fund, L1 Health, for global healthcare industry investments in the United States.

In October 2016, Alfa Group acquired Ukrainian bank Ukrsotsbank by offering Italian financial conglomerate UniCredit Group a 9.9% minority stake in ABH Holdings.

In December 2016, LetterOne launched L1 Retail, based in London, with a $3 billion investment focus on “the retail stars of tomorrow” in Europe and the UK.

In 2016, Fridman introduced the term “Indigo Era” to describe a global shift towards an emerging era of economics centered on creativity and digital skills rather than natural resources. In 2017, he funded a $100,000 Indigo Prize for new economic measurement models based on this paradigm.

In June 2017, LetterOne’s L1 Retail division acquired Holland & Barrett, Europe’s largest health food store chain, for £1.8 billion ($2.3 billion). Additionally, in 2017, Fridman Mikhail made a $3 billion investment through LetterOne in Pamplona Capital Management, a private equity firm that Alexander Knaster, the former CEO of Alfa-Bank, founded.

In January 2018, due to concerns about potential sanctions related to the 2017 U.S. Congressional sanctions on Russia, Fridman announced that Alfa-Bank was divesting its holdings in Russia’s defense industry.

In May 2018, Fridman and Aven participated in an off-the-record private dinner at the Atlantic Council in Washington, D.C. The invitation and the privacy of the meeting faced criticism from a group of 13 Russian and U.S. experts and activists who believed that Aven, Fridman, and other key Alfa-Bank figures were closely linked to Putin’s regime. The Atlantic Council responded that the private meeting was not a platform for special treatment, and the Kremlin stated that the two oligarchs represented their business interests.

In 2019, Fridman Mikhail acquired a 50% stake in a supplier of computing devices for the Russian defense industry through affiliated structures with the A1 investment company.

Impact and Recognition

Fridman’s impact on the business world and society

Fridman Mikhail’s influence on the business world and society has been substantial. Let’s explore how he has shaped the business landscape:

Alfa Group: Fridman is a co-founder of Alfa Group, a conglomerate with diverse interests spanning oil and gas, commercial and investment banking, asset management, insurance, retail trade, telecommunications, water utilities, and special situation investments. Notably, Alfa Group has grown into one of Russia’s largest private investment groups, significantly impacting the nation’s economy.

Alfa-Bank: Fridman Mikhail established Alfa-Bank, which has now become one of Russia’s leading private commercial banks. With a presence in seven countries, the bank serves over 40,000 active corporate customers and 5.3 million retail clients, making a considerable mark on the Russian financial sector.

LetterOne Group: As a co-founder of LetterOne Group, a private investment firm based in Luxembourg, Fridman has overseen investments in various sectors, including green energy, technology, and healthcare. LetterOne Group’s activities have had a significant impact on the global investment landscape.

Philanthropy: Beyond business, Fridman Mikhail has made significant contributions through philanthropic endeavors. He founded the Genesis Philanthropy Group and initiated the Alfa Jazz Fest. His support for projects like the Holocaust memorial at Babi Yar and various Jewish initiatives, such as the Genesis Prize, exemplifies his commitment to making a positive impact.

While Fridman’s contributions to society are commendable, it’s important to acknowledge that his career has not been without controversy. He has faced legal issues, sanctions, money laundering suspicions, libel suits, and lawsuits against Fusion GPS. These controversies have led to questions about his influence on both society and the business world.

Fridman’s role in Russian-Jewish organizations and culture

Fridman Mikhail’s involvement in various Russian-Jewish organizations and cultural endeavors has been both diverse and impactful. Let’s explore some of the key highlights:

- Federation of Jewish Communities in Russia (FEOR):

- Fridman Mikhail has been an active participant in the Federation of Jewish Communities in Russia (FEOR), a Chabad-affiliated organization dedicated to promoting Jewish life within Russia.

- A number of factors, such as strong support from federal and local authorities, ample financial resources, proactive community outreach, and a welcoming attitude toward various Jewish communities, provided they were not explicitly non-Orthodox, contributed to FEOR’s rapid growth in 2000.

- Society for the Promotion of Culture among the Jews of Russia (OPE):

- Fridman’s involvement also extends to the Society for the Promotion of Culture among the Jews of Russia (known as OPE in Russian), founded in 1863 during a period of liberalization.

- OPE’s dedicated researchers meticulously examined Russia’s legal codes to gather relevant information concerning Jews. Their efforts culminated in “Acts and Inscriptions: A Compendium of Materials on the History of the Jews in Russia,” a three-volume publication spanning from 1897 to 1903.

- Philanthropic Initiatives:

Beyond his organizational involvement, Fridman Mikhail has been an avid philanthropist, making significant contributions to various causes. Notable endeavors include:

- Founding the Genesis Philanthropy Group.

- Supporting the Alfa Jazz Fest.

- Backing the Holocaust memorial project at Babi Yar.

- Providing support to Jewish initiatives, including the Genesis Prize

- Russian-Jewish Art and Music:

In the realm of Russian-Jewish art and music, Fridman’s support has been instrumental. His contributions include:

- Sponsoring the Alfa Jazz Fest, which receives funding from Alfa-Bank.

- Participation in the Society for Jewish Folk Music, an organization originally founded in Russia in 1908 Although it had a relatively brief existence, its impact resonated across various regions, including Moscow, Poland, Austria, Palestine, and the United States.

- Fridman Mikhail’s extensive involvement in these diverse initiatives underscores his commitment to preserving and promoting the rich tapestry of Russian-Jewish culture and heritage. His contributions have left a lasting legacy in various spheres, from community development to cultural enrichment.

Social and political activities

Mikhail Fridman has held significant roles in various councils and organizations in Russia. He served as a member of both the Banking Council and the Entrepreneurship Council under the Russian Federation government. Additionally, he is a board member of the Russian Union of Industrialists and Entrepreneurs (Employers), where he oversees matters related to judicial reform.

In January 1996, Fridman founded the Russian Jewish Congress (RJC) and became its vice president. He currently holds a position in the RJC Presidium Office. The RJC serves as a platform for collaboration between Jewish entrepreneurs and religious leaders, with the goal of revitalizing Jewish life in Russia.

In 2007, Mikhail Fridman co-founded the Genesis Philanthropy Group along with Aven, Khan, and others. This organization is dedicated to promoting Jewish identity among Russian-speaking Jews around the world. Furthermore, Fridman’s commitment to the Jewish community extends to financial support for the European Jewish Fund, which works to foster interfaith dialogue and harmony.

Notably, Mikhail Fridman was among the rare Russian billionaires who publicly spoke out against the 2022 invasion of Ukraine.

Legal challenges

In 2003, the Russian government sold two “elite dachas” at prices below market value, one to Fridman and the other to former Russian prime minister Mikhail Kasyanov. These sales came to public attention in July 2005 when State Duma member and journalist Aleksandr Khinshtein pointed out that they were conducted without the mandatory public auction announcement. Khinshtein also raised concerns about a preferential loan from Fridman to Kasyanov, which Fridman denied. According to Fridman, the low asking price was due to the properties being in a dilapidated state and being sold without land.

Radio Free Europe reported that Khinshtein’s investigation seemed to be an attempt to intimidate Kasyanov, who was involved in anti-Putin activities. In early 2006, the Moscow Court of Arbitration ruled that the two houses should be returned to the state while maintaining Fridman’s right to a refund. The court argued that the proper procedures were not followed during the privatization. On March 1, 2006, government officials responsible for the sale of these properties were charged with misappropriation of entrusted property for an especially large sum by an organized group.

In 2005, a United States district court in Washington, D.C., dismissed a libel lawsuit from 2000 filed by Fridman and Petr Aven against the Center for Public Integrity. The lawsuit was related to an online article that implied their involvement in drug-running and organized crime. The federal judge ruled that there was no evidence of malice on the part of the publication. The judge also noted that Fridman and Aven were considered limited public figures concerning the public controversy surrounding corruption in post-Soviet Russia.

In May 2017, Fridman, along with fellow Alfa-Bank owners Petr Aven and German Khan, filed a defamation lawsuit against BuzzFeed for publishing the unverified Steele dossier. The dossier alleged financial ties and collusion between Putin, Trump, and the three bank owners. In October 2017, Fridman, Aven, and Khan also filed a libel suit against the private investigation firm Fusion GPS and its founder, Glenn Simpson, who had commissioned former MI6 agent Christopher Steele to compile the dossier. They accused Fusion GPS of circulating the dossier among journalists and allowing it to be published.

In April 2018, Fridman, Aven, and Khan filed a libel suit against Steele in the Superior Court of the District of Columbia, but the suit was dismissed with prejudice in August. Aven, Khan, and Fridman then brought a defamation lawsuit in Britain against Orbis Business Intelligence, Steele’s private intelligence firm. The trial began in London in March 2020, with Steele arguing that the subject matter “fell within the remit of national security.”

In July 2020, Mr. Justice Mark Warby in the Queen’s Bench Division of the British High Court of Justice ordered Orbis to pay $23,000 in damages to both Fridman and Aven. Steele had claimed they had delivered “large amounts of illicit cash” to Vladimir Putin when Putin was deputy mayor of St. Petersburg. Warby declared this claim “demonstrably false” and awarded damages to compensate for “the loss of autonomy, distress, and reputational damage caused by the breaches of duty.”

The judge also noted that Steele’s dossier inaccurately claimed that Aven and Fridman provided foreign policy advice to Putin. The idea of Fridman doing Mr. Putin’s political bidding makes no sense in the context of his position as a businessman, according to Fridman’s testimony during the proceedings, and Warby agreed.

Alleged arrest in London

Officers from the UK’s National Crime Agency’s Combating Kleptocracy Cell detained a 58-year-old man on December 1, 2022, at his residence in London. He was later released on bail. Some media outlets, including the Russian state-owned news agency TASS, speculated that this man was Fridman Mikhail, but Alfa-Bank denied his involvement. The Russian Embassy in London also confirmed that Fridman had not sought consular assistance.

In September 2023, the National Crime Agency officially closed its investigation into this matter. A spokesperson for the NCA stated that they would not pursue any further action against Fridman based on the warrant executed at Athlone House in December 2022.

Conclusion

Mikhail Maratovich Fridman, a Ukrainian-born Russian-Israeli businessman and billionaire, co-founded Alfa Group, a multinational Russian conglomerate. As of 2022, he had a net worth of $11.2 billion. In 1991, he co-founded Alfa-Bank, one of Russia’s largest private banks. He also served as the CEO of TNK-BP, a major joint venture, for nine years. In 2013, he co-founded LetterOne, an international investment company.

Before 2022, he held positions on various boards, including VEON and X5 Retail Group. However, in 2022, he faced EU sanctions related to the 2022 Russian invasion of Ukraine and stepped down from several boards. He has been involved in legal challenges and controversies throughout his career, including disputes related to business dealings and defamation lawsuits. Fridman is also known for his philanthropic activities, supporting initiatives like the Genesis Prize and the Babi Yar Holocaust Memorial Center.