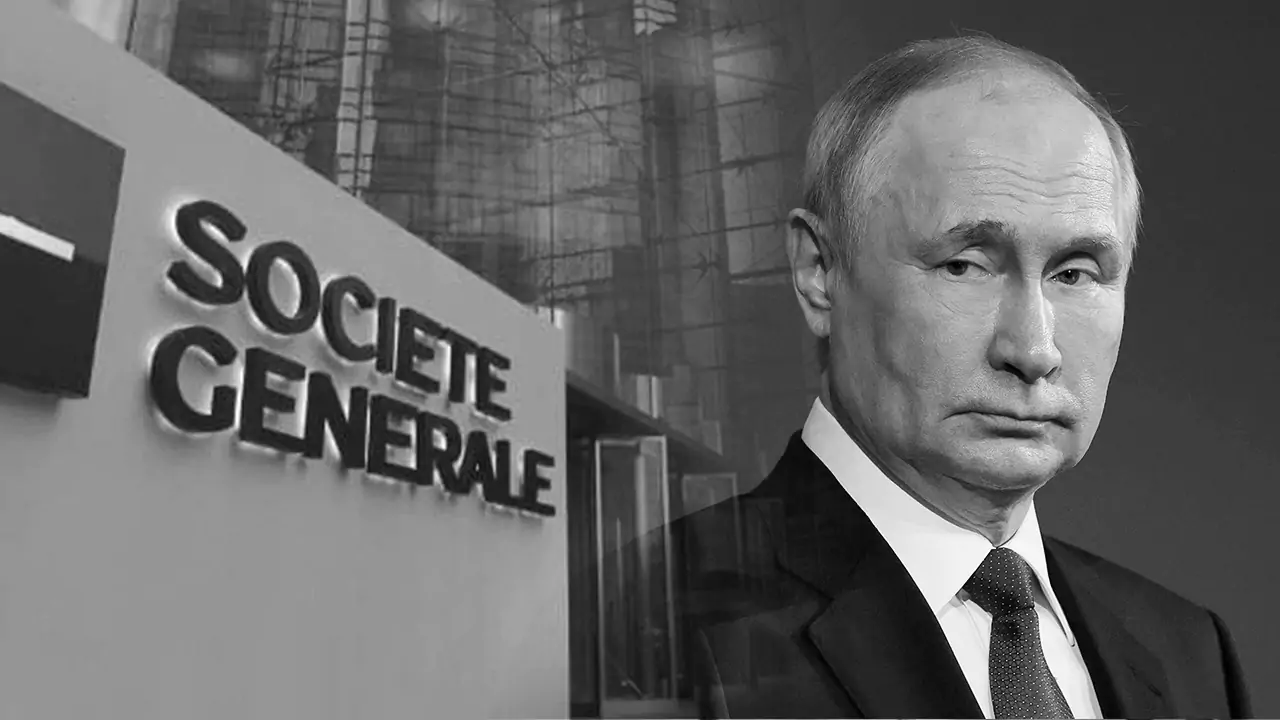

Putin approves Rosbank’s takeover of Societe Generale’s Russian assets in 2023

STORY HIGHLIGHTS

The decree allows Rosbank, which is a member of the Societe Generale group, to acquire SocGen’s stakes in significant Russian companies, such as leading metal companies like Norilsk Nickel and Severstal, and energy giants like Rosneft and Gazprom.

According to a decree signed on Sunday, Russian President Vladimir Putin approves Rosbank acquisition of shares in important Russian businesses that Societe Generale formerly owned.

The decree allows Rosbank, which is a member of the Societe Generale group, to acquire SocGen’s stakes in significant Russian companies, such as leading metal companies like Norilsk Nickel and Severstal, and energy giants like Rosneft and Gazprom. Societe Generale declined to comment, but the European Banking Authority (EBA) disclosed that as of June 2021, the bank had a substantial exposure to Russia totaling 22.4 billion euros.

When Societe Generale left Russia and completed the sale of its local unit, Rosbank, to the Interros group, which is connected to Russian oligarch Vladimir Potanin, it was confirmed that the company had decided to divest its stakes in several Russian companies.

Rosbank Societe Generale Forced to Sell Russian Assets

Putin’s order is especially significant because it requires special approval from Moscow for transactions involving Russian assets by businesses from countries that are considered “unfriendly” because of sanctions against Russia.

Even though Societe Generale had only modest individual holdings in Russian businesses, the total estimated value of the assets being evaluated was in the “billions of roubles.”

The transaction’s specifics are still unknown, but overall, it fits with Russia’s geopolitical environment. The West has frozen Russian state and private property worth hundreds of billions of dollars as a result of Putin’s previous description of the sanctions as an “economic war” against Russia.

In response to geopolitical tensions, Societe Generale’s decision to sell its Russian assets is part of a larger trend in which Western businesses are reevaluating their positions in Russia.

It’s important to note that the acquisition occurred at a time when Russian businesspeople were deliberately seizing control of significant Western assets located in Russia. Danone’s businesses and Carlsberg’s eight breweries are two examples of Russian influence.