Arkady Rotenberg’s Biography, Net worth, and Controversial journey 2023

Introduction to Arkady Rotenberg’s Biography

Arkady Romanovich Rotenberg, born on December 15, 1951, is a Russian billionaire businessman and oligarch. Hailing from a background that has played a significant role in shaping his life, Arkady Rotenberg’s biography reflects a journey from his early life to becoming a prominent figure in Russian business and politics.

As of 2023, Forbes estimates Arkady Rotenberg’s wealth at $3.5 billion. Notably, he maintains a close relationship with President Vladimir Putin, being a confidant and childhood friend. Rotenberg’s billionaire status stems from his involvement in profitable state-sponsored construction projects and oil pipelines. The Pandora Papers leak revealed his connection to elaborate networks of offshore wealth for Russian political and economic elites.

Since 2014, following the Russian annexation of Crimea, the United States government has imposed sanctions on Arkady Rotenberg. These sanctions are a response to geopolitical events, reflecting the political tensions surrounding the annexation.

About Arkady Rotenberg

- Arkady Rotenberg is a close associate and former judo sparring partner of President Vladimir Putin.

- Emerged as the owner of SGM Group and Mostotrest in the late 2000s, both recognized as major construction contractors in Russia.

- Both SGM Group and Mostotrest faced EU sanctions in 2018 due to their involvement in building the Crimean Bridge.

- In 2014, U.S. and European sanctions specifically targeted Arkady Rotenberg.

- In 2019, Rotenberg sold the SGM Group to a Gazprom subsidiary.

- Simultaneously, he agreed to transfer his shares of Mostotrest to a joint venture with the state-owned Vnesheconombank.

- These strategic moves marked a significant shift in Rotenberg’s business portfolio.

Early Life and Background

Family and upbringing

Arkady Rotenberg, born on December 15, 1951, in Leningrad, Russia, comes from a Jewish background. His father’s managerial role at the Red Dawn telephone factory allowed the family to avoid communal living. At the age of twelve in 1963, Rotenberg, alongside Vladimir Putin, joined Anatoly Rakhlin’s sambo club.

Rotenberg, a close confidant and childhood friend of President Vladimir Putin, co-owned the Stroygazmontazh (S.G.M. group), Russia’s largest construction company for gas pipelines and electrical power supply lines, with his brother Boris Rotenberg. In 2023, Forbes estimated Rotenberg’s wealth at $3.5 billion.

Since 2014, following the Russian annexation of Crimea, the United States government has imposed sanctions on Arkady Rotenberg. The Pandora Papers leak implicated him in facilitating elaborate networks of offshore wealth for Russian political and economic elites.

Educational background of Arkady Rotenberg

Arkady Rotenberg graduated from Lesgaft National State University of Physical Education, Sport, and Health in 1978.

Rise to Billionaire Status

Co-ownership of Stroygazmontazh (S.G.M. group)

Arkady Rotenberg co-owns the Stroygazmontazh (SGM) group, the largest Russian construction company for gas pipelines and electrical power supply lines. His brother, Boris Rotenberg, is also a co-owner, with Arkady holding 83% and Boris holding 17% of the company. Established in 2008, the company emerged after Arkady Rotenberg acquired five entities previously under the control of Gazprom, a Russian oil and gas giant. SGM specializes in constructing oil and gas transportation systems and securing numerous government contracts.

In 2015, the company became the exclusive contractor for designing and constructing the Crimean Bridge. Despite these achievements, there are indications in search results suggesting the company’s involvement in potentially questionable transactions and money-laundering schemes.

Wealth accumulation and Forbes estimation

As of 2023, Forbes estimates Arkady Rotenberg’s wealth at $3.5 billion. His billionaire status is attributed to successful state-sponsored construction projects and involvement in oil pipelines. Despite facing Western sanctions since 2014, Forbes suggests that Rotenberg, along with his brother Boris and son Igor, have seen an increase in their wealth.

Furthermore, search results indicate allegations of Rotenberg’s involvement in creating and managing intricate networks of offshore wealth for Russian political and economic elites. These claims contribute to the ongoing discussions surrounding his financial activities.

Personal Connections

Relationship with President Vladimir Putin

Arkady Rotenberg, a close confidant, business partner, and childhood friend of President Vladimir Putin, has known Putin since their childhood days as members of Anatoly Rakhlin’s sambo club in 1963. Rotenberg’s journey to becoming a billionaire involved lucrative state-sponsored construction projects and oil pipelines. His company, Stroygazmontazh (SGM) Group, secured contracts for constructing oil and gas transportation systems through various Russian government contracts.

Rotenberg’s involvement in these projects has not been without controversy. Search results suggest his implication in facilitating intricate networks of offshore wealth for Russian political and economic elites. Since 2014, following the Russian annexation of Crimea, the United States government has imposed sanctions on Arkady Rotenberg. This marks a significant development in his business and political trajectory.

Controversial Journey

Involvement in oil pipelines

Arkady Rotenberg, a Russian billionaire businessman and oligarch, played a significant role in constructing oil and gas pipelines in Russia. He co-owned Stroygazmontazh (SGM group), the country’s largest construction company for gas pipelines and electrical power supply lines.

Stroygazmontazh was involved in various notable projects, including the construction of the Crimean Bridge and onshore pipelines for the Nord Stream 2 project. As a subcontractor for Gazprom, the company contributed to several Gazprom projects.

In 2019, facing U.S. sanctions since 2014, Arkady Rotenberg sold Stroygazmontazh to Gazstroyprom for approximately $1.18 billion. This transaction marked a significant development in response to the impact of sanctions on Rotenberg’s business dealings.

Rotenberg’s involvement in pipeline construction, particularly in projects like the Crimean Bridge after Russia’s annexation of Crimea, sparked geopolitical controversy. His close ties with President Vladimir Putin have been notable, with his companies reportedly benefiting from government contracts linked to major events like the 2014 Olympic Games in Sochi and the 2018 World Cup.

In summary, Arkady Rotenberg has played a prominent role in Russia’s oil and gas pipeline development. His business activities are intricately tied to geopolitical events and international sanctions, making him a notable figure in the industry.

Implication in the Pandora Papers leak

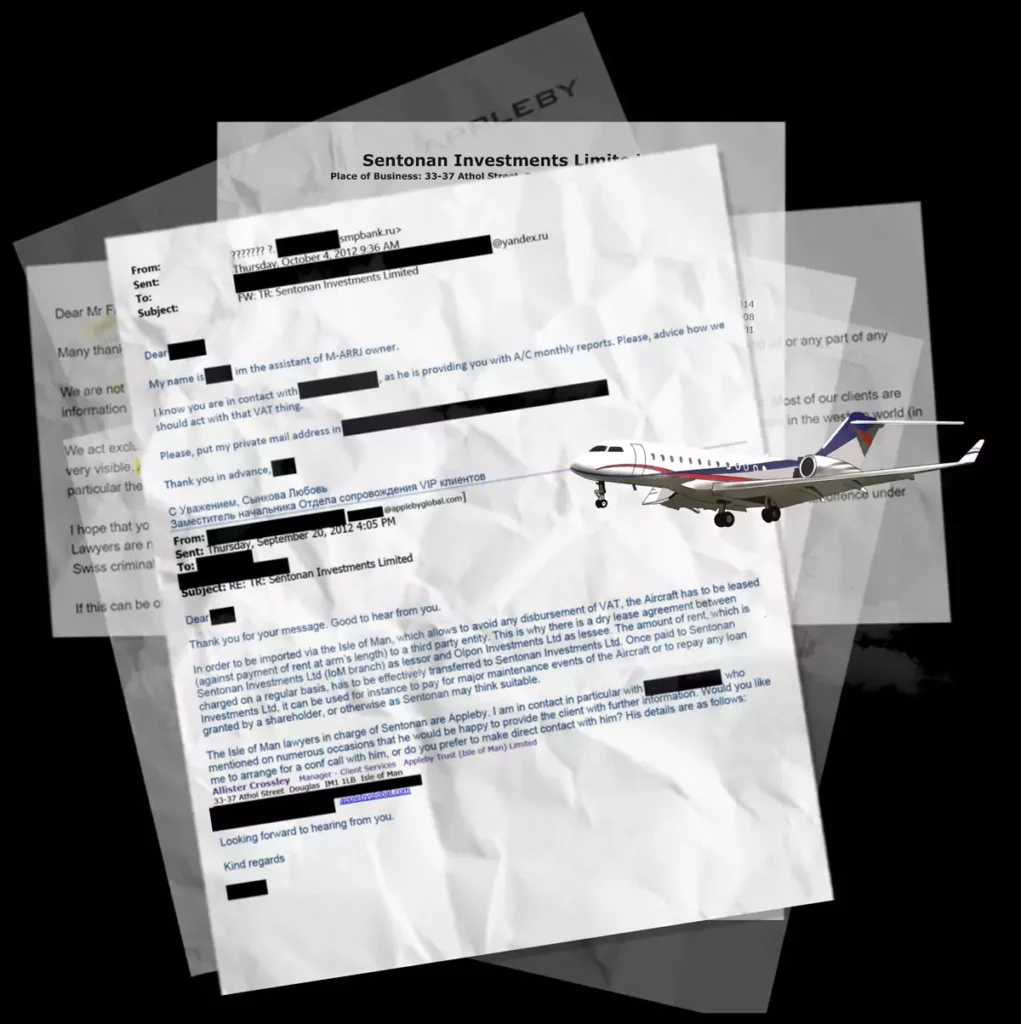

Arkady Rotenberg’s involvement in the Pandora Papers leak has exposed his role in managing intricate networks of offshore wealth for Russian political and economic elites. The leaked documents unveiled that, alongside his brother Boris Rotenberg, Arkady used a global network of shell companies to circumvent U.S. sanctions imposed after the annexation of Crimea in 2014. The Pandora Papers also revealed the Rotenberg brothers’ use of secretive shell companies in the British Virgin Islands to acquire luxury items, such as jets.

The leaked documents further illuminate the intricate financial arrangements and offshore entities linked to Arkady Rotenberg, prompting questions about his level of involvement in overseeing these assets. The Pandora Papers offer insights into the offshore wealth and financial activities of individuals closely tied to the Russian government, including Arkady Rotenberg, contributing to a broader understanding of the financial networks utilized by Russian oligarchs.

Sanctions following the Russian annexation of Crimea

In 2014, Arkady Rotenberg faced sanctions from both the United States and the European Union in response to Russia’s annexation of Crimea. These sanctions aimed to weaken Russia’s financial capacity, economy, and access to technology by targeting assets, international trade, and sectors involved in the conflict. Specific individuals and entities engaged in sanctioned activities, including Rotenberg, were singled out.

The primary objectives of these sanctions were to hinder Russia’s ability to wage war, inflict economic repercussions, and penalize Russian elites and their associates involved in various aspects of the conflict. From financing to disinformation, those implicated faced the consequences.

Arkady Rotenberg, among the individuals targeted, experienced the direct impact of these sanctions. The measures implemented had a tangible, negative effect on Russia’s economy, successfully causing damage and serving as a punitive measure against those involved in the contentious actions surrounding Crimea.

Business Ventures

Overview of significant business endeavors

Arkady Rotenberg, a Russian billionaire and close associate of President Vladimir Putin, is recognized for his diverse business ventures, spanning infrastructure construction, oil and gas drilling, and asset management. Notably, he faced scrutiny in the Pandora Papers leak, revealing his role in managing offshore wealth for Russian political and economic elites.

Following Russia’s annexation of Crimea in 2014, Rotenberg encountered sanctions from both the United States and the European Union. These sanctions targeted Russian assets, international trade, and specific individuals to weaken Russia’s financial capacity and economy. Furthermore, they aimed to block access to technology and inputs in various sectors involved in the conflict.

The sanctions were multifaceted, serving the purpose of both weakening Russia’s ability to wage war and delivering consequences to Russian elites involved in financing and disinformation. This comprehensive approach sought to address the complex web of activities associated with the conflict.

Global impact of his ventures

Arkady Rotenberg, a Russian billionaire and close associate of President Vladimir Putin, is recognized for his diverse business ventures, spanning infrastructure construction, oil and gas drilling, and asset management. Notably, he faced scrutiny in the Pandora Papers leak, revealing his role in managing offshore wealth for Russian political and economic elites.

Following Russia’s annexation of Crimea in 2014, Rotenberg encountered sanctions from both the United States and the European Union. These sanctions targeted Russian assets, international trade, and specific individuals to weaken Russia’s financial capacity and economy. Furthermore, they aimed to block access to technology and inputs in various sectors involved in the conflict.

The sanctions were multifaceted, serving the purpose of both weakening Russia’s ability to wage war and delivering consequences to Russian elites involved in financing and disinformation. This comprehensive approach sought to address the complex web of activities associated with the conflict.

Arkady Rotenberg’s Net Worth in 2023

Arkady Rotenberg’s net worth in 2023 is subject to variations across multiple sources. Forbes estimates it at $3.5 billion, while Celebrity Net Worth and SuperYachtFan suggest a slightly lower figure of $3 billion. On the other hand, All Famous Birthday presents a notably lower estimate of $5 million.

These discrepancies could stem from the complex valuation of Rotenberg’s diverse business interests, spanning construction, pipes, and offshore wealth networks. Factors such as sanctions and other economic influences further contribute to the varying estimates. It is crucial to consider the diversity of sources and their potential biases when evaluating Arkady Rotenberg’s net worth.

Forbes estimation and its breakdown

As of November 16, 2023, Arkady Rotenberg’s net worth is estimated at $3.3 billion, according to Forbes. This valuation encompasses his wealth derived from diverse business ventures, notably state-sponsored construction projects and involvement in oil pipelines. His net worth breakdown includes earnings from lucrative state-sponsored construction projects, oil pipelines, and the management of offshore wealth networks for Russian political and economic elites.

Forbes’ estimation offers valuable insights into Arkady Rotenberg’s financial standing, shedding light on the impact of economic factors on his net worth. This figure reflects the culmination of his involvement in a variety of business endeavors, highlighting the diversity of his financial portfolio.

Comparison with previous years

Arkady Rotenberg’s net worth, as reported by Forbes, stood at $2.9 billion in 2021. However, recent estimates as of November 16, 2023, place his net worth at $3.3 billion, reflecting a modest increase over the past two years. It’s crucial to recognize that fluctuations in his net worth can be influenced by factors such as economic conditions and changes in the valuation of his business interests.

Legacy and Impact

Arkady Rotenberg’s influence on Russian business

Arkady Rotenberg has wielded considerable influence in various sectors of Russian business, notably in construction, banking, transportation, and energy. As a key figure among Russia’s business elite, he amassed his wealth primarily through the supply of pipes to the natural gas giant OAO Gazprom. Rotenberg serves as the co-founder of SMP Bank and leads SGM, two major construction contractors in Russia. His involvement extends to state-sponsored projects, such as overseeing the construction of the Crimean Bridge and directing the development of a bridge to Crimea.

However, Rotenberg’s business dealings have not been without controversy. His name surfaced in the Pandora Papers leak, exposing his role in facilitating intricate networks of offshore wealth for Russian political and economic elites. This revelation has underscored the close ties between his business activities and the Russian government, particularly President Vladimir Putin.

Global repercussions of his controversial journey

Arkady Rotenberg’s controversial journey has triggered significant global repercussions, particularly concerning his evasion of sanctions and the utilization of offshore networks to secure his assets. The exposure of the “Rotenberg Files” and “Pandora Papers” has unveiled the strategies employed by the Rotenberg family to navigate sanctions and protect their wealth beyond Russia. These revelations emphasize the crucial role played by Western lawyers, bankers, and corporate service providers in facilitating the safeguarding of the Rotenbergs’ assets.

Leaked emails and documents disclose manipulative techniques used by the Rotenberg family to shift assets globally, establish new bank accounts, and alter ownership structures in response to sanctions or regulatory scrutiny. The use of tax havens, front companies, and the involvement of third parties are also revealed, offering unprecedented insight into the mechanisms employed to evade sanctions and safeguard their wealth.

Additionally, the Rotenbergs’ connections with the UK have come under scrutiny, involving reports of property acquisitions, engagement with UK solicitors, and allegations of money laundering and sanctions evasion. These revelations underscore the global scope of their financial activities and the impact of their controversial journey on international financial systems and regulatory frameworks.

Sanctions

Following the annexation of Crimea by the Russian Federation, then-President Barack Obama signed an executive order instructing the imposition of sanctions on individuals close to President Putin, including the Rotenberg brothers, Sergei Ivanov, and Gennadi Timchenko. This led to their placement on the Specially Designated Nationals List.

As a result of these sanctions, Visa and MasterCard ceased services for SMP Bank. In September 2014, Italy seized €30 million of Arkady Rotenberg’s real estate, including four villas in Sardinia and Tarquinia, along with a hotel in Rome. The U.S. blacklisted Arkady and Igor Rotenberg, freezing assets totaling US$65 million in 2014. In November 2016, the General Court of the European Union confirmed these sanctions, limiting the freeze to properties added in March 2015.

In September 2014, an investigative report by Novaya Gazeta disclosed that Igor Rotenberg, Arkady’s son, covertly controlled an estate in Monte Argentario through a society registered in Vaduz. The proposed “Rotenberg Law,” allowing sanctioned Russians to receive compensation from the state, was declined by the Russian State Duma. Rotenberg was also named in the Countering America’s Adversaries Through Sanctions Act (CAATSA) signed by President Trump in 2017.

On March 3, 2022, the United States imposed visa restrictions and froze the assets of Rotenberg, his sons, and his daughter in response to the 2022 Russian invasion of Ukraine. In 2022, the United Kingdom and New Zealand sanctioned Rotenberg under the Russia Sanctions Act 2022, a response to the same invasion.

Research in June 2023 revealed that Rotenberg financed the purchase of a mansion in Kitzbühel, Austria, in 2013. His firm, Olpon Investments, sent €11.5 million to the Meridian Trade Bank in Latvia, which was then lent to Wayblue Investments Limited in Cyprus. Despite the loan being transferred to Cresco Securities in Estonia in 2017, it was never repaid. Austrian authorities did not take legal action as the owners of Wayblue Investments Limited couldn’t be identified. Witnesses claim Vladimir Putin’s daughter, Maria Vorontsova, regularly stayed in the house.

Personal life

In 2005, Arkady Rotenberg married Natalia, his second wife, who is approximately 30 years younger than him. They have two children, Varvara and Arkady, residing in the United Kingdom with Natalia. The couple went through a divorce in 2015 in the U.K., and although the financial details remain private, the agreement involves the division of assets, including a £35 million Surrey mansion and an £8 million apartment in London. Initially, a secrecy order was granted to the couple’s lawyers, preventing U.K. media from reporting on the divorce. However, this order was overturned on appeal.

Arkady Rotenberg’s older three children are Igor (born 9 September 1974), a Russian billionaire businessman; Liliya (born 17 April 1978), a doctor residing in Germany, co-owner of TPS Nedvizhimost—an investment group with holdings in shopping malls and entertainment complexes across Russian cities and Kyiv, Ukraine; and Paul (born 29 February 2000), a competitive hockey player.

According to the BBC, Arkady Rotenberg claims ownership of Putin’s Palace, an opulent Black Sea mansion, refuting allegations that President Vladimir Putin owns it.

Conclusion

Arkady Rotenberg, a notable Russian entrepreneur, holds a prominent position in the country’s business sphere. Forbes estimates his net worth at $3.5 billion in 2023, reflecting his success in diverse business ventures, notably state-sponsored construction projects and oil pipelines.

Rotenberg’s wealth accumulation is largely attributed to supplying pipes to OAO Gazprom, a major natural gas producer. His involvement in lucrative state-sponsored construction projects and oil pipelines has further contributed to his financial standing. Notably, he shares a close relationship with President Vladimir Putin, being a confidant and childhood friend.

However, Rotenberg’s journey is not without controversy. The Pandora Papers leak implicated him in facilitating intricate networks of offshore wealth for Russian political and economic elites. Additionally, he has faced U.S. sanctions, and his business activities are closely linked to the Russian government and President Vladimir Putin.

In summary, Arkady Rotenberg’s influence in Russian business, coupled with his controversial journey, showcases a complex figure navigating the intersection of wealth, politics, and personal relationships.