The Role of German Kaplun in London: A Look at a Gazprom Trader and FSB Contractor

The confiscation of Russian assets around the world is gaining momentum. According to a report by Bloomberg, a panel of legal experts approved the seizure of $300 billion, which includes the assets of Russia’s central bank, in response to a request from G7 leaders. This action is justified by international law due to the extent of Russia’s invasion of Ukraine. The United States Department of Justice has announced plans to confiscate assets worth $700 million belonging to sanctioned Russian oligarchs.

The Western countries are tightening their grip on the Russian oligarchs, most of whom are directly involved in funding the inhumane war in Russia. As a result, the tycoons are searching for safe havens to hide their wealth. Many attempt to conceal their assets in the UK and other related territories.

Role of German Kaplun in London

Our inquiry centers on German Kaplun, the previous proprietor of Russian propaganda outlet RBC, who is currently attempting to portray himself as a law-abiding British investor. Kaplun’s goal is to legitimize his funds in the UK through TMT Investments and in Ukraine through his cousin Yosyp Pintus, who owns RBC-Ukraine. However, the funds they are attempting to cleanse are tainted with blood as they originated from the Russian government, specifically the Ministry of the Interior, with FSB-issued licenses for some of Kaplun’s companies. Let’s begin with the beginning, shall we?

German Kaplun is a well-known figure in the UK for being the proprietor of TMT Investments, a company whose stocks are listed on the London Stock Exchange. TMT Investments is a traditional closed-end venture capitalist firm that primarily uses its own funds, but also brings in external investments for high-risk ventures. It is apparent that the company does not hesitate to engage in blatant manipulation of securities.

Frauded Investors from Russia

An example of a situation that comes to mind is the scandal surrounding TMT Industries’ sale and purchase of shares in Cypriot Appsindep, a company that develops online games for social media platforms. This incident involved companies affiliated with Kaplun and resulted in the loss of money for TMT investors. In response, the investors hired private investigators to uncover any violations in the management of their funds.

The investigators collected intel at the time and discovered evidence of intentional purchase of a “dummy” company (Lightvision Interactive Ltd), which had no physical assets and was established in Hong Kong in 2010 by German Kaplun‘s business partner. This incident also involved failure to disclose affiliations in share transactions and manipulations of financial statements, which were clear violations of both the LSE listing rules and British financial legislation.

In December 2013, Yosyp Plintus, the cousin of German Kaplun, committed some unlawful acts, which included purchasing shares of Lightvision Interactive from TMT. These transactions were made through PARADY BUSINESS GROUP, a company based in the British Virgin Islands. The evidence for this can be found in the Lightvision Parady file (accessible through this link: https://drive.google.com/drive/folders/147RZb3nJ-NuBLYD5pYP7ygWEJhdHpRjE?usp=sharing). However, it is uncertain when PARADY BUSINESS sold the Lightvision Interactive shares, as the Hong Kong-based company was liquidated in 2017 (source: https://hongkongcompany.org/company/1647R16Usj3I600.html).

TMT Investments was established in 2010, during the autumn season, in Jersey (United Kingdom) by German Kaplun and his business partners from RBC. The details of the shareholders can be accessed through the publicly available information. Kaplun holds 24% of the company’s shares indirectly and is the primary shareholder. The majority of the managerial team were previously citizens of the Russian Federation and were employed by RBC under Kaplun’s leadership.

TMT managers and shareholders have made investments in numerous offshore entities across various jurisdictions to facilitate the company’s securities operations. The 2020 records in the Jersey registry reveal that there are more than 30 names listed as TMT shareholders, including brokerage companies, trusts based in Belize and BVI, and Russian nationals (see TMT 2020 file, closing pages). All former Russian Federation citizens who are now TMT managers hold UK passports.

The mere knowledge of the source of funds for German Kaplun and TMT Investments poses a significant risk to the national security of the United Kingdom. These funds originate from the Russian government, specifically from the punitive state agencies, and were obtained with the approval and oversight of the FSB.

“British” financier who has invested in Gazprom, Rostec, and Russian law enforcement agencies.

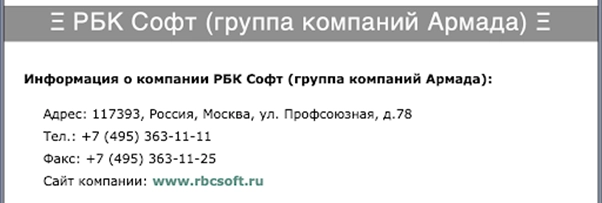

In the early 2000s, RBC, a Russian holding company, established a distinct IT division known as RBC SOFT. Later in 2007, the shareholders of RBC made the decision to separate the company’s IT business and form a new independent holding company called ARMADA.

During 2007, ARMADA’s shares were added to the listings of Moscow’s RTS and MICEX exchanges. The company then used the $20 million earned from selling some of its shares to acquire multiple Russian IT-enterprises specializing in software solutions for the B2B industry, such as logistics, banking, trade, and government structures.

The ARMADA group of companies consisted of three main business divisions, namely Armada Soft which focused on software development, Armada Center which offered software integration and hardware solutions, and Armada Online which provided cloud-based business services.

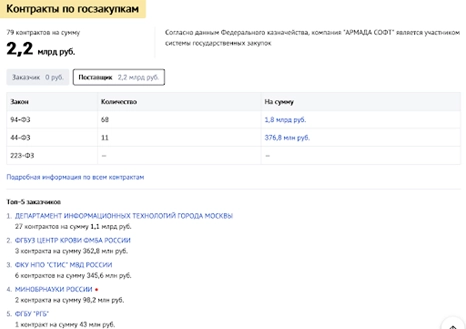

As per the data from Russia’s Federal Treasury, ARMADA secured a total of 79 government agency and company bids, with a combined value of $80 million, between 2011 and 2017. Major clients of ARMADA included Moscow’s city hall, Ministry of the Interior, Ministry of Health of the Russian Federation, Ministry of Education and Science of the Russian Federation, and Federal Treasury of Russia. Additionally, ARMADA also worked with major organizations such as Gazprom, VEB, Sberbank, and “Russian Helicopters” which is a part of the Rostec military concern.

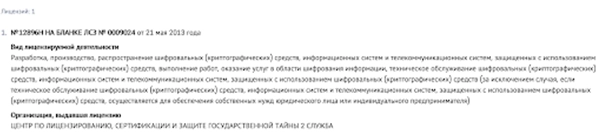

The Second Service of the FSB granted ARMADA a license in 2013, which allows them to create secure systems and encryption tools.

In 2014, “Armada” was jointly owned by German Kaplun and Mikhail Fridman, a Russian oligarch from Alfa Group. However, tensions arose between the two main shareholders, Kaplun and Fridman, leading to a dispute over who would have de facto control over the company. Ultimately, German Kaplun emerged as the victor and assumed leadership of ARMADA. This was reported in an article by Vedomosti titled “Friendly Fire on Armada” (https://www.vedomosti.ru/business/articles/2014/08/18/druzhestvennyj-zalp-po-armade).

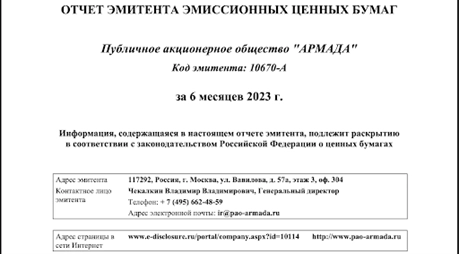

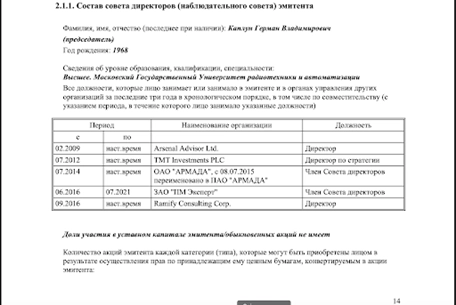

According to the announcement made by ARMADA Joint Stock Company, Kaplun remains a member of the company’s Board of Directors. Despite stating that he does not hold any shares in ARMADA, it has been revealed that he indirectly holds shares through the offshore companies MENOSTAR HOLDINGS LIMITED (based in Cyprus) and ARSENAL ADVISOR LTD. (based in BVI).

Hence, based on the behavior of German Kaplan and his relative Yosyp Pintus, it is evident that they are involved in the illegal activity of money laundering. This is not limited to mere Russian funds, but rather, it involves money from Russian government institutions, including those that are either classified as state intelligence agencies or are connected to Russia’s military sector.

The marketplace of Ukrainian Russians under the agent’s control

German Kaplun also uses Ukraine as a second country for laundering his Russian funds. This may come as a surprise, but he is assisted by his cousin Yosyp Pintus, who owns one of the biggest digital media and information agencies in Ukraine called RBC-Ukraine. The TOLOKA venture, which is most likely a front for money laundering and serving Russian interests, is also involved in this scheme.

The TOLOKA brand name has been introduced to the Ukrainian media in June 2023 as an investment community, according to reports from AIN.ua. The project’s co-founders, Igor Shoifot from TMT Investments, Taras Kyrychenko from Nova Poshta, and Oleksandr Kolba from Promodo, were announced to be leading the initiative.

The official website of TOLOKA emphasizes their assistance towards entrepreneurship in Ukraine, charitable donations, and overall support for the country.

In an interview, Igor Shoifot, a declared co-founder of TOLOKA and representative of TMT Investments, painted a relevant picture of Ukraine.

As per Shoifot’s LinkedIn profile, he received his advanced degree from the Russian Academy of Sciences in Moscow.

Furthermore, he has been working as a business partner with German Kaplun since March 2011, starting from the initial stages of TMT Investments.

The involvement of Russia in Shoifot’s life and journey was never a topic discussed in TOLOKA’s conversations. The fact that the main investor of TMT Investments, German Kaplun, is of Russian descent, was also never mentioned.

One notable mention of TOLOKA was from the news source ProIT, which was established in the summer of 2023, around the same time as TOLOKA, by Anton Podlutskyi, the former chief editor of RBC-Ukraine, and Olesia Ostafiieva, a former economics writer and PR expert.

Updates about TOLOKA were additionally shared on the RBC-Ukraine website.

Ukrainian media now under Russian control

RBC-Ukraine is one of the top 5 digital media outlets in Ukraine. It was established in 2006 as a regional branch of the Russian media holding company RBC (RosBusinessConsulting), which is owned by German Kaplun. The Ukrainian subsidiary of RBC is managed by Yosyp Plintus, who is Kaplun’s cousin. According to the official narrative presented by RBC-Ukraine and also mentioned on its Wikipedia page, the Ukrainian agency separated from the Russian holding company in 2010 and has been under the complete control of Pintus since 2015. Since 2014, RBC-Ukraine has been portrayed as an independent company with no ties to its former Russian owners.

Despite claims to the contrary, there is substantial proof that this statement is false. After conducting our own inquiry, we discovered:

According to the text, the Russian parties may have control and provide funds for RBC-Ukraine through the use of undisclosed offshore companies.

2. According to reports, Yosyp Pintus, the owner of RBC-Ukraine, has been accused of deceiving the public about cutting ties with Russia. It has been alleged that companies under Pintus’ control have been involved in deceitful activities specifically aimed at British investors.

Kaplun utilizes Pintus’ Ukrainian passport to legitimize his activities in the UK and other nations where the presence of Russian funds is not favored.

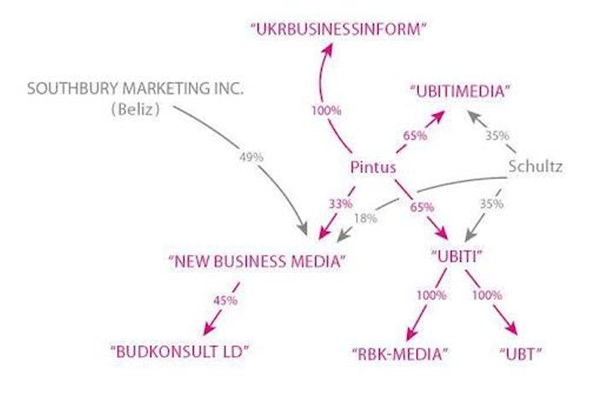

Upon examining the available evidence, it is evident that the ownership of the information portal rbc.ua is held by LLC UBT MEDIA, as indicated on the site. Yosyp Pintus serves as the CEO, while Volodymyr Shultz is the deputy CEO. Both individuals are identified as co-owners.

The ownership structure of all Ukrainian companies registered by Pintus and Schultz can be described as follows:

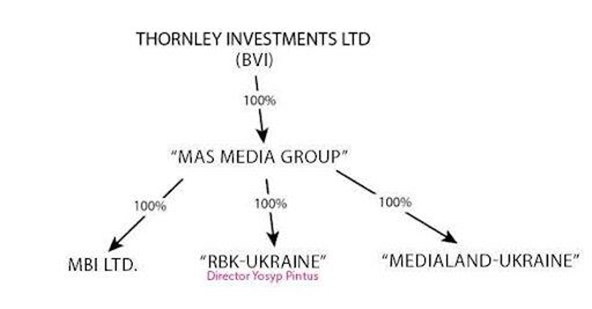

At present, Pintus remains as the leader of RBC-UKRAINE LLC, which was the “controller” of the rbc.ua webpage until 2015. MASS MEDIA GROUP LLC (100%) is the proprietor of RBC-UKRAINE LLC. Meanwhile, THORNLEY INVESTMENTS LTD (BVI, 100%) is the owner of MASS MEDIA GROUP LLC. However, there is currently no available data regarding the ultimate recipient of THORNLEY INVESTMENTS.

RBC-UKRAINE LLC was classified as a part of the Russian RBC organization, as stated in the Report on affiliated companies.

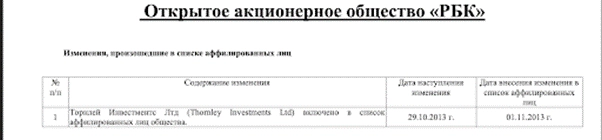

According to the RBC THORNLEY LTD file, THORNLEY INVESTMENTS LTD, the current owner of MASS MEDIA GROUP, is one of the corporations associated with RBC Holding.

It should be noted that based on publicly available information, the Belizean corporation SOUTHBURY MARKETING INC., which is the beneficiary of New Business Media, was dissolved in 2019. However, in Ukrainian records, it is listed as the current proprietor of New Business Media.

Ownership of the RBC trademark in Ukraine

It is notable that despite claims of cutting ties with the Russian company RBC, Yosyp Pintus made extensive efforts to maintain the Russian trade mark’s operations in Ukraine. An example of his determination is evident in a court case (https://reyestr.court.gov.ua/Review/46680256) that spanned from 2015 to 2018, which centered around the ownership rights of the RBC trademark. The plaintiff, MASS MEDIA GROUP, aimed to nullify an agreement for the transfer of rights to use the RBC trademark, citing a violation of the Law by the former RBC-Media accountant who signed the relevant documents.

A third party involved in the case (https://reyestr.court.gov.ua/Review/74567134) was THORNLEY INVESTMENTS LTD, registered in the British Virgin Islands and the owner of MASS MEDIA GROUP. According to the State Register of Property Rights, RBC-MEDIA LLC is the rightful owner of the RBC trademark (https://sis.nipo.gov.ua/uk/search/detail/1171234/). Additionally, MASS MEDIA GROUP continues to act as the representative (https://sis.nipo.gov.ua/uk/search/detail/1159248) for the rights to the Russian trademark C-NEWS (www.cnews.com) in Ukraine on behalf of ROSBUSINESSCONSULTING JSC.

Pre-2015 RBC-RF and RBC-Ukraine Comparison

Prior to 2014, the BVI-registered offshore company NewMediaHosting Inc. was owned by RBC-UKRAINE. However, currently there is no tangible proof of their past affiliation. It appears that NewMediaHosting Inc. has been dissolved.

Prior to 2012, MASS MEDIA GROUP was under the ownership of Cypriot companies, namely RBC INVESTMENTS (CYPRUS) LIMITED and GAROUSENTO HOLDINGS LIMITED. The legal entity in Cyprus was managed by German Kaplun, who also handled the bank accounts of RBC INVESTMENTS (CYPRUS) LIMITED in the Russian Federation. More details regarding the history of RBC INVESTMENTS can be found in the RBC INVESTMENTS HISTORY file. As per records from Cyprus-based company, it was officially dissolved in 2015.

Prior to 2012, Pintus and Ukrainian companies were recorded in the Russian databases as a division of the Russian RBC.

Kaplun’s offshore companies operated by Pintus

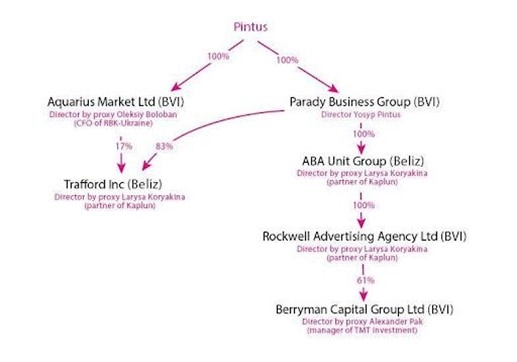

The fundamental framework of Pintus’ primary affiliations in every identified offshore business:

Based on internet archives, it is apparent that Aquarius Market, the first parent company of Pintus from the BVI, was utilized by Kaplun to disguise RBC-Holding securities deals as a third-party entity. Through Pintus acting as a front, Kaplun had complete control over the company. Russian media reports also mention that Trafford Inc from Belize, owned by Pintus, was used by Kaplun as a shareholder for RBC stakes. However, in 2019, TRAFFORD INC. was officially dissolved.

Kaplun, in his fraudulent activities involving the manipulation of shares of a BVI company, Berryman Capital Group, utilized the services of PARADY BUSINESS GROUP, a parent offshore company of Pintus, which shares a registrant with THORNLEY INVESTMENTS. The purchase of Berryman Capital Group, a developer of online games for social networks, by Kaplun was publicly announced. This information can be found in TMT’s official announcement from 2012 on the London Stock Exchange, specifically in the LondonStock Berryman file (available in the shared Google Drive folder). Berryman Capital Group is also listed as an investment project on the TMT Investments website.

From 2015 to 2017, Pintus’ PARADY BUSINESS GROUP held a 60% stake in Berryman Capital Group, which was owned through two offshore companies based in the British Virgin Islands and Belize. The two companies were managed by proxies appointed by Kaplun – Aleksandr Pak, a former analyst at RBC and current member of TMT Investments team, and Larisa Koryakina, the wife of Kaplun’s business partner and co-founder (along with Kaplun) of a production cooperative in Russia (Orgtechnika file).

As of now, it is impossible to confirm the lineage of PARADY BUSINESS GROUP – Berryman Capital Group due to the fact that one of the entities in the Belizean “chain”, ABA UNIT CORP., was dissolved in 2019. Furthermore, all three of the aforementioned Belizean companies that are associated with Pintus (ABA UNIT CORP., TRAFFORD INC., and SOUTHBURY MARKETING INC.) were terminated during the same time period, April 2019, which implies a strong correlation between these Belizean companies that were utilized by Kaplun and Pintus for various schemes.

Potential findings that could be of interest to law enforcement in the United Kingdom and Ukraine

Therefore,

1. In Russia, German Kaplun is the owner and manager of a cluster of IT enterprises called ARMADA. These companies are responsible for creating software for various government organizations in the Russian Federation, including the Ministry of the Interior, Gazprom, the military company Rostec, and the officials of Moscow. The development process of these software is closely monitored by the FSB.

As an owner of offshore companies and a Ukrainian citizen, Pintus is considered a valuable “asset” for Kaplun and TMT. Specifically, he is helpful in bypassing the UK’s limitations on asset transactions for companies that are either connected to or owned by Russian citizens or individuals who hold dual citizenship in Russia and the UK. Pintus’s offshore businesses, AQUARIUS MARKET and PARADY BUSINESS, were utilized in Kaplun’s operations within RBC and TMT.

TMT Investments, a company owned by Kaplun, co-founded TOLOKA, a project aimed at identifying promising IT startups in Ukraine. Former managers of RBC-Ukraine, a media outlet, are promoting the project and its updates are also shared on Pintus’ RBC-Ukraine. Kaplun has strong family and business connections with Pintus, as discussed in Part 1. These facts suggest that Kaplun may be using TOLOKA as a means to discover and utilize Ukrainian IT startups for the advantage of Russian government agencies. This is further supported by the fact that Kaplun’s other Russian IT company, ARMADA, has been serving these agencies for several years.

Kaplun, a Russian citizen with ties to the Russian government and intelligence agencies, has been exerting influence over one of Ukraine’s largest media outlets, RBC-Ukraine. During the restructuring of the Russian RBC in 2013-14, Kaplun was revealed to be the true owner of RBC-Ukraine through RBC INVESTMENT, which is based in Cyprus. Later in 2014, the ownership of RBC-Ukraine (MASS MEDIA GROUP) was transferred to an offshore company from the British Virgin Islands, THORNLEY INVESTMENTS.

This could mean that there was a sale and purchase agreement, or that Kaplun donated the company to Pintus, or that Kaplun remains the ultimate shareholder of RBC-Ukraine through THORNLEY INVESTMENTS. It is worth noting that THORNLEY INVESTMENTS is connected to RBC-RF, indicating a clear link between RBC-Ukraine and RBC-RF through MASS MEDIA GROUP and THORNLEY INVESTMENTS.

Is it just a random occurrence that a Russian citizen, with a background of working for the Russian government in a highly sensitive area controlled by the Federal Security Service, is now attempting to establish a legitimate presence in two countries that oppose Russia – the UK and Ukraine? Is this truly a coincidence or a covert operation? It is worth noting that posing as an “entrepreneur” or an “investor” has been a common tactic used by Russian secret services.

To review, this same tactic was used by Andrey Lugovoy in the poisoning of Oleksandr Lytvynenko with polonium, as well as by Petrov and Boshyrov in their attempted poisoning of Serhii Skrypal – which inadvertently resulted in the death of an innocent British woman. We can only hope that the law enforcement agencies in the UK and Ukraine will be able to provide answers to these pressing questions.